The 5G network is going to be a whole lot faster.

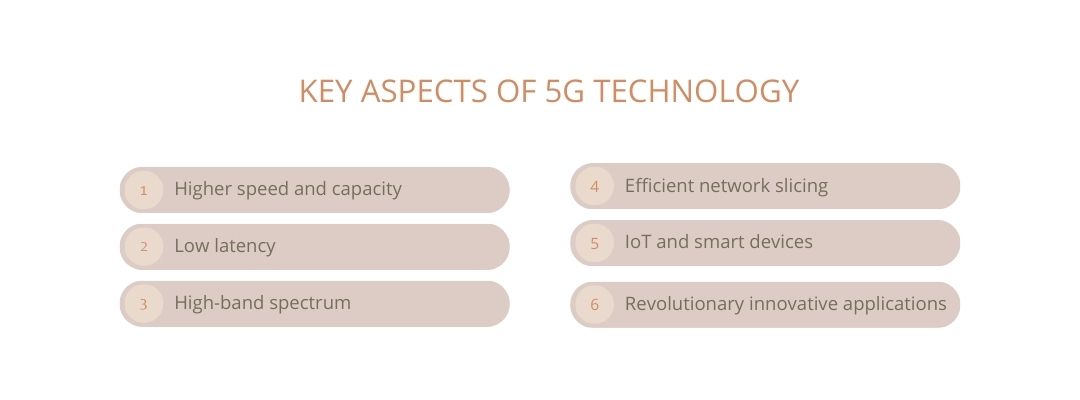

The era of hyperconnectivity is upon us and the 5G network rollout has ignited a digital revolution across industries, including insurance. The post-COVID world has grown accustomed to faster turnouts and convenience, which means under 10-minute deliveries, on-call consultations and unprecedented access to everything. For it, a consumer requires hyper speed and flawless connectivity. As the fifth generation of wireless technology, 5G promises unparalleled speed, reduced latency, and the ability to connect many devices simultaneously. These features are set to accelerate data processing and significantly enhance customer experiences in the InsurTech domain.

The Technological Shift

The Technological Shift

The emergence of 5G technologies is a futuristic leap forward for consumers and insurers alike. New spectrum frequencies will facilitate the adoption of mobile devices, accelerating the shift of business models to digital platforms. Insurers can come to expect mobile channels to become the dominant gateway for consumers, completely digitising the customer experience end-to-end. Consumers on the other hand can come to expect a more streamlined, simplified insurance process enabled by faster 5G connectivity and Artificial Intelligence (AI) intervention. 5G technology will prove to be a game changer for the InsurTech industry; this is how.

Optimised Speed With 5G

One of the biggest reasons for ChatGPT’s success is speed. You’re getting your questions answered almost instantly. Now imagine this kind of efficiency in the insurance realm. 5G taps into new spectrum frequencies to deliver download speeds up to 100 times faster than 4G, enabling InsurTech companies to process vast amounts of data quickly. This speed is crucial for functions such as real-time risk assessment, personalised policy recommendations, and instant claims processing. Based on Accenture's research, companies that allocate resources towards advanced network capabilities like 5G can anticipate a 2.5-fold increase in revenue over the next three years.

A leading InsurTech company relies on AI to expedite its claims process in as little as 3 seconds. With 5G, such processes can become a lot faster and more efficient.

5G Enhancing Customer Experience

Customer experience is the critical differentiating factor in the competitive insurance space. 5G technology can enhance this experience by enabling more interactive and responsive customer service. Take chatbots for example. Chatbots and virtual assistants powered by AI can provide instant responses to customer inquiries, significantly reducing waiting times and optimising customer service experience.

The ageing population of the Western world has come to rely heavily on technology to monitor their health and keep track of their intensive lifestyles. The emergence of 5G technology is revolutionising the healthcare sector by simplifying the integration of Internet-connected devices. Video consultations, remote patient monitoring, and seamless data sharing between patients and caregivers will be available for the ageing population. This level of personalisation and proactive service can greatly elevate the customer experience.

Risk Assessment and Real-Time Data

5G's capability to support real-time data communication is a game-changer for risk management in the insurance industry. Insurers can now access and analyse data from various sources, such as smart homes, connected cars, and health monitors, to assess risks more accurately and offer dynamic pricing models.

For example, connected cars equipped with 5G can transmit data about driving behaviour, speed, and location in real-time. In the case of a car crash, cars can generate real-time data and reports, allowing insurers to investigate quickly and provide claims promptly. Insurers can use this data to calculate premiums based on driving behaviour and estimated risk factors.

Role of 5G in Claims Processing

It is imperative for insurers to factor 5G into their technology roadmaps for enhanced claim processing and endpoint customer interaction. Instant response time, low latency, and real-time data exchange with audio/video evaluation will profoundly contribute towards faster claim processing, reduced manual labour, improved customer service and adequate fraud detection.

It is highly likely insurers can deploy drones equipped with 5G to disaster-struck areas to analyse the damage and process claims more efficiently. This not only speeds up the claims settlement process but also improves accuracy and customer satisfaction.

Conclusion

Although 5G networks have arrived in India, we’ve yet to witness its innovative usage in the InsurTech industry. Digital infrastructure is still lacking in several parts of India, let alone access to the advanced 5G technology. It is crucial to bridge this technological gap to accelerate insurance adoption if we’re to fulfil IRDAI’s ambitious vision, ‘Insurance for all by 2047’.