India is projected to be the fastest-growing insurance market among G20 countries from 2024 to 2028. A rapidly growing middle class, resilient economy, innovation, and regulatory support are the key drivers of the country’s insurance sector. The young, aware, and tech-savvy population has pushed the demand for insurance to be provided via digital channels, opening new sources of revenue for insurers. Despite digitisation and a massive market, the insurance industry faces several challenges in India. Here’s a look at the key challenges being faced by insurance companies in India and how to navigate them.

1. Low Penetration

The insurance industry often faces a lack of trust. The lack of awareness in the underserved markets and misinformation act as massive obstacles to gaining customer trust. On the other hand, macroeconomic instability and inflation have forced insurers to increase premiums. Due to these reasons, the insurance industry has the highest cost of customer acquisition, creating barriers to accessibility.

Navigating the Challenge

Leveraging advanced technologies can play an instrumental role in eliminating challenges that hinder penetration. AI-powered data assessment tools facilitate the discovery of new opportunities to sell insurance policies, manage risk, tailor marketing, and automate underwriting. These expedite the customer’s journey from discovery to sale. Digitisation brings a level of transparency where users can read the documents and clarify doubts in real time. This helps build customer trust. Furthermore, digital channels can enhance customer retention rate, increasing the customer lifetime value (CLV) for the insurance provider. This is particularly important, as the cost of customer acquisition can be as much as 9X higher than retention. Once trust is built, retaining customers becomes easier with personalised offerings, tailored communication, and transparency.

2. Increased Risk with Climate Change

India is exposed to several natural disasters due to climate change. Earthquakes, droughts, cloudbursts, and floods are among the most common ones that occur almost every year in multiple states. In the first 9 months of 2023, India suffered a disaster almost every day! These instances have more far-reaching consequences for properties and lives. They also result in deteriorated quality of life, increased vulnerability to diseases, crop damage, etc. The deteriorating air quality across tier-1 and now tier-2 cities adversely affects the health of residents. These risks strain the country’s economy and the insurance sector. In severe cases, they may even lead to market failures.

Navigating the Challenge

As 93% of exposures in India (including businesses, individuals, and property) are uninsured, the insurance sector has a huge market to capture. However, these markets are turning increasingly riskier and more unpredictable. Advanced technologies leverage huge volumes of data, pattern recognition, and predictive analytics to improve risk assessment for insurers. InsurTech companies in India empower insurance providers to identify high-risk individuals, businesses, regions, and classes to refine their offerings and recommend adequate coverage, thereby improving customer experience.

3. Evolving Customer Expectations

In the hyper-personalised world of today, customers need insurance policies tailored to their specific needs. Although the insurance industry is digitising rapidly, the legacy business models operate on traditional practices that introduce delays to product innovation and market launch. Innovation is key to unlocking the dormant potential of the unserved and underserved markets in India. Agility in tailoring products and rapidly adapting to customer needs are the cornerstones of success in the digital world.

Navigating the Challenge

Navigating the Challenge

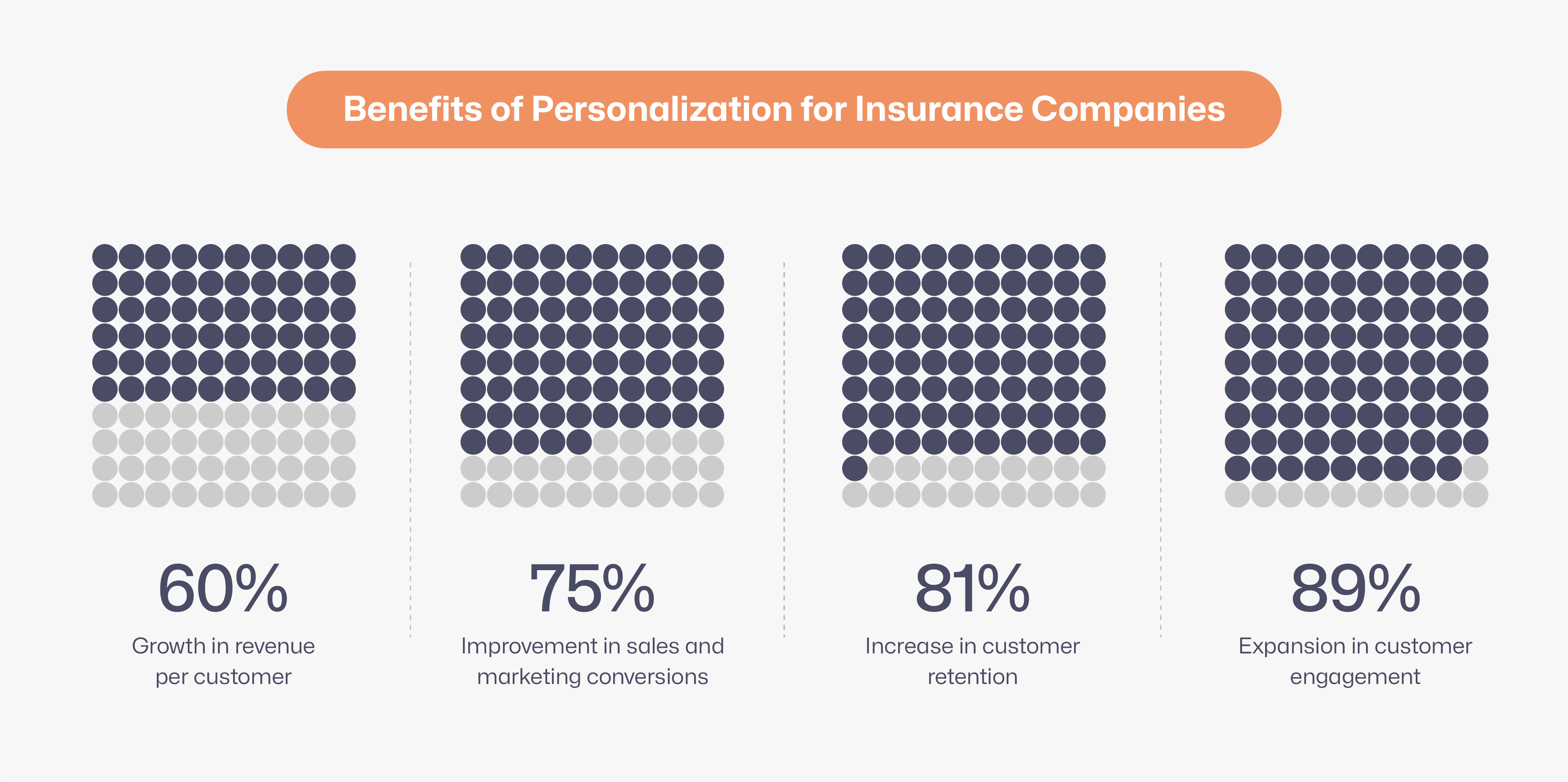

Insurers must provide customer-centric and real-time recommendations to grab attention. However, product simplicity and communication remain key to converting potential customers. Insurance companies in India must leverage data analytics while ensuring ethical data consumption and sharing practices across the industry and among third parties to swiftly respond to customer needs. A data-driven approach accelerates customer segmentation, targeting different personas and predicting evolving insurance needs. These are extremely helpful in cross-selling and upselling. The good news is that InsurTech solutions providers can support insurance companies in India to manage all these at scale with affordable investments in the right technology and infrastructure.

4. Cyber Crime

While digital disruption has proven beneficial across industries, it has significantly expanded the attack surface for cybercrime. Since 2021, cybercrime is the leading risk for insurance companies. The threat affects the industry from two dimensions - technology failure claims and the vulnerability of insurance companies’ own systems to cyber threats. Cyber dangers, such as ransomware attacks, data breaches, and phishing scams, cause financial losses and damage reputation and customer trust. Insurance companies handle massive customer data and huge repositories of reports. Further, digitally operated claims and underwriting systems are critical to an insurance company. Any damage to these systems can wreak havoc on the business model. The online ecosystem with cloud-based and third-party operations heightens the risks of maintaining a resilient cyber posture.

Navigating the Challenge

Most industries leverage cyber-insurance to mitigate the risks of digitisation. However, the insurance industry needs a stronger safety net. Insurers must partner with InsurTech companies in India that make security a top priority. They can offer complete protection to the go-to-market strategy and its execution, cloud storage, and data communication channels. All data assets must be protected at rest and in transition, along with technology resources, decision-making servers, and across various touchpoints. InsurTech companies in India that follow a robust incident management strategy can create an effective response plan and minimise the impact of a cyberattack.

5. Compliance and Fraud Prevention

Licensing requirements, lengthy product approval processes, and stringent reporting obligations weigh down on insurance companies. Additionally, the need to mitigate fraud with KYC and AML measures imposes additional requirements in the sales process that overwhelm customers. While these are essential to fraud prevention, they extend the time to market and customer onboarding.

Navigating the Challenge

Maintaining compliance in an evolving ecosystem, while staying ahead of the competition is paramount for insurers. This is where InsurTech companies can assist with automation and secure anonymised data-sharing to minimise the overheads for insurers. It reduces friction across product launch and sales functions. Automated audits and self-learning backend systems can transform the way insurance companies handle and manage change.

Opportunities Galore

The IRDAI recognises the importance of bridging protection gaps to reduce financial losses at the individual and national levels. The 2047 target of “Insurance for All” is in line with the organisation’s vision and mission. India’s Insurance industry must navigate challenges to capitalise on the opportunities that are poised to unfold over the next couple of decades.

Championing technology is key to overcoming the challenges of the insurance industry in India. InsurTech empowers insurance companies to increase penetration while meeting compliance and overcoming threats. An experienced InsurTech company can drive insurance policy sales, with customer acquisition, engagement and retention, with digital underwriting and claims processing. Harnessing data intelligence can be a game-changer for insurers, with InsurTech aiding product personalisation and settlement in real time. This bridges the trust deficit and bolsters the security posture to drive higher adoption rates.

Bibliography

https://www.swissre.com/institute/research/topics-and-risk-dialogues/economy-and-insurance-outlook/india-insurance-market-growing-fast-build-resilience.html (last accessed on August 7, 2024)

https://ibapplications.com/content-library/blog/the-top-5-challenges-facing-the-insurance-industry-today/ (last accessed on August 7, 2024)

https://www.pwc.co.uk/insurance/assets/pdf/insurance-banana-skins-2023.pdf (last accessed on August 7, 2024)

https://www.gicouncil.in/news-media/gic-in-the-news/cyber-risks-in-insurance-sector/ (last accessed on August 7, 2024)

https://www.pwc.in/assets/pdfs/industries/financial-services/insurance/indias-insurance-vision-challenges-and-the-way-forward.pdf (last accessed on August 7, 2024)

https://www.ibef.org/blogs/digitalizing-insurance-in-india (last accessed on August 7, 2024)

https://www.iiadallas.org/page/75 (last accessed on August 7, 2024)

https://www.downtoearth.org.in/climate-change/extreme-weather-2023-india-saw-a-disaster-nearly-every-day-from-january-september-93024 (last accessed on August 7, 2024)