Bundling insurance with the purchase of a product or service at the point of sale (POS), is opening up a plethora of opportunities for insurance companies in India. Embedded insurance also enhances customer journeys, making it easy to access warranties and insurance on a wide range of items. Insurance companies are playing a key role in allowing such bundling of insurance at the POS while giving insurers simple and affordable access to underserved and untapped markets.

Take the case of rural India. This largely underserved market is seeing high demand for life insurance. However, selling services in these remote areas has traditionally been difficult. With advances in the insurtech sector and the rise of embedded insurance, insurers can offer numerous products, ranging from hospital cash benefits to credit life insurance and personal accident cover. In fact, insurance companies in India are looking at delivering their offerings through microfinance firms without needing to depend on expensive distribution channels, such as traditional banks.

In addition, an increasing number of insurers are partnering with e-commerce companies to deliver hassle-free insurance at checkout to purchase electronics and other large-ticket goods. Insurtech companies in India are easing such partnerships by enabling seamless integration of AI/ML, big data analytics and other technologies via frictionless application programming interfaces (APIs). In other words, embedded insurance proves to be an effective way to overcome the major challenge of low insurance penetration in India.

How Embedded Insurance is Disrupting the Sector?

Embedded insurance is still in its nascent stages, with the potential to expand to a trillion-dollar market. Due to its inherent ability to facilitate immense personalisation and convenience, this sector is expected to grow 46% from 2023 to 2029 to reach a value of ₹1,61,442 crores. It eases the purchase flow for the customer by making insurance an "add-on" to the primary purchase with just one click. There is no tedious paperwork to take care of and the payment is made while paying for the primary product. Since insurtech tools bring insights into the specific customer’s preferences through data analytics, the insurance can be tailored not just to match the main product but also the customer’s needs.

On the other hand, customer acquisition costs are reduced for insurance companies in India since the customer already wants to buy the main product and the insurance comes along with it. This eliminates the need to market the policy and take the customer through the entire sales funnel. For example, travel aggregator sites are bundling travel insurance for trip delays or cancellations, lost baggage and more when a flight ticket is booked. Similarly, online taxi services are offering ride insurance for as little as ₹2 when you book a cab.

This makes embedded insurance a win-win for both the merchant and the insurer, where the depth and breadth of embedded products can be increased at scale. Leading insurtech companies in India play a crucial role in enabling such expansion. They are working with insurers, banks, microfinance institutions, e-commerce firms, travel aggregators and electronics brands to embed insurance into their sales process.

The growing popularity of embedded insurance is being driven by multiple factors, such as:

The growing popularity of embedded insurance is being driven by multiple factors, such as:

Customer convenience: Insurance can be obtained without the need for any additional steps or paperwork.

Advancements in Technology: Insurtech enables easy integrations via APIs to allow insurers to bundle their products within the retail ecosystems.

Distribution Partnerships: A digital infrastructure eases the collaboration of insurance and non-insurance brands to leverage synergies and embed coverage.

Data-Driven Decision-Making: These partnerships enable access to vast customer datasets, empowering insurers to personalise their products for customers and make strategic business expansion decisions.

The benefits of this new revolution insurance have led EY to estimate that over 30% of all insurance purchases will occur through embedded channels by 2028. And this is only the tip of the iceberg. To capitalise on this growing trend, you first need to understand the opportunities it offers and the challenges you need to overcome to leverage these opportunities.

Opportunities Offered by Embedded Insurance

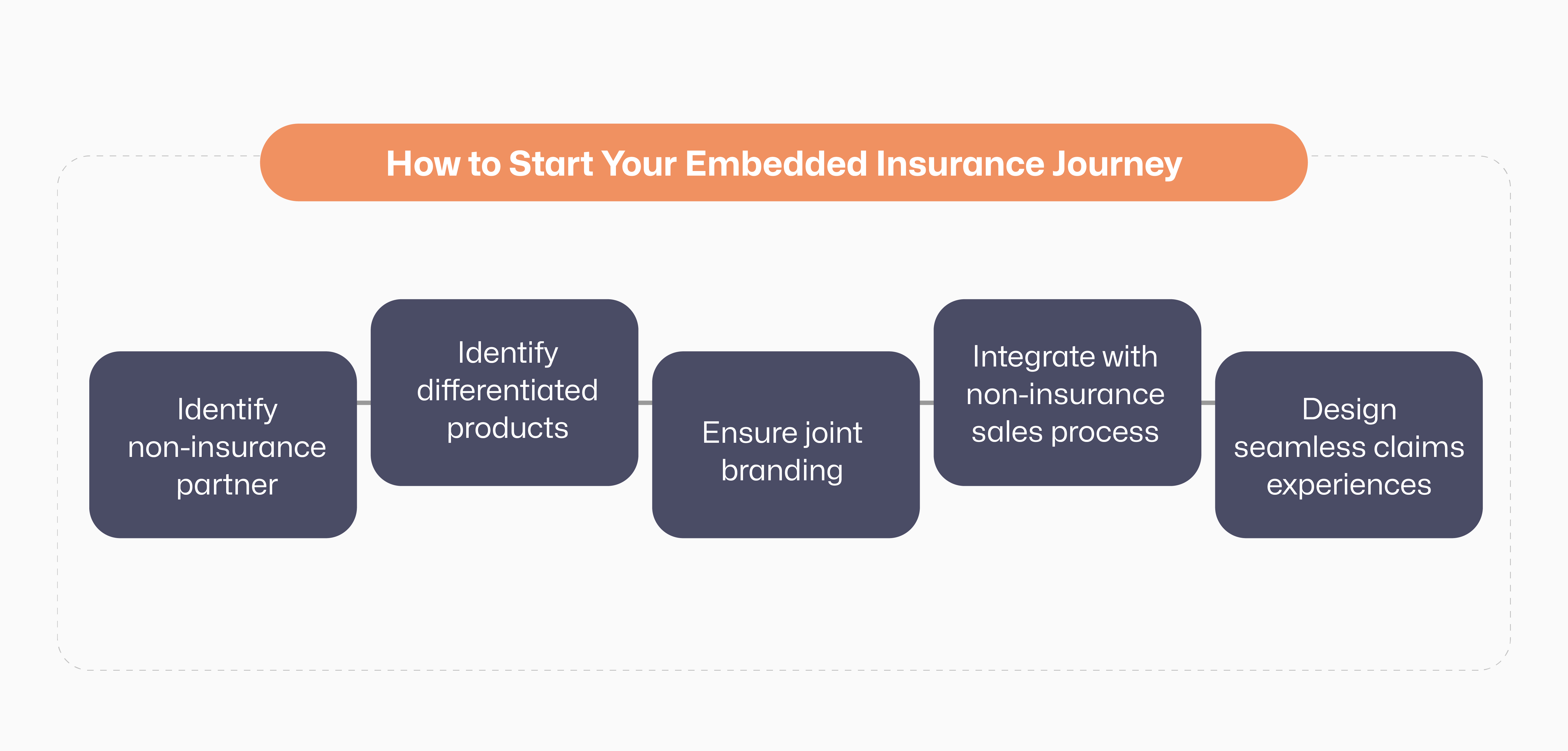

Selling insurance products through partnerships with manufacturers is nothing new. However, these distribution collaborations have been far from optimal due to fragmented customer experiences, high costs, undifferentiated features and underwriting risks. With the advent of digitalisation and insurtech, these shortcomings are being overcome through embedded insurance. Here's a look at the multitude of opportunities this development presents for insurance companies in India.

Consistent and Satisfying Customer Experiences

With the seamless integration of insurance as the POS, customers get a frictionless, convenient and quick experience. Without the need for additional steps to purchase insurance, the process has become immensely intuitive and personalised. Partnerships with insurtech companies in India power insurers with data analytics capabilities to deliver smoother buying experiences tailored to each customer's needs and preferences. A key example of this is the rise of on-demand insurance. This is a cost-effective and flexible solution to get coverage only when you need it. Ride insurance, provided by online cab services, offers such on-demand insurance. You are covered for a single trip, meeting your immediate needs, rather than paying an annual premium to keep a policy active even when you do not require it.

Enhanced Operational Efficiency

By integrating your insurance products with an existing and popular platform, you not only reduce administrative costs but can also streamline operations with the power of automation. You no longer need to spend extensively on marketing and sales either. Your policies are clubbed with appropriate products and services so that customers receive a bundled package at the point of purchase.

Higher Market Penetration

Embedding insurance into everyday purchases opens a wide range of opportunities for insurers to reach customers online. In fact, this method allows access to customers who might have otherwise not considered buying insurance with a product. Not only does this expand coverage to untapped and underserved markets, but it also increases overall penetration.

Better Risk Management

With access to real-time data and analytics capabilities, insurance companies in India can offer dynamic coverage options and pricing. Partnerships facilitate data sharing between retailers and insurers, driving data-driven decision-making for both parties. This data also helps assess risks in real time to improve underwriting and policy provision.

.jpg)

Challenges of Embedded Insurance

The new business model can drive diversification of product offerings and expand the addressable market for insurers. It also enables them to proactively meet emerging customer needs, respond to new market trends and deliver value-added experiences. However, to do so, insurance companies in India need to overcome the challenges presented by this business model.

Integration Challenges

Interoperability is a primary challenge, wherein insurers need to ensure seamless integration of their products across diverse platforms. This requires the development of products that are compatible across systems and the use of robust APIs. Attempting to achieve all this in-house is resource-intensive. Partnering with a leading insurtech company in India gives access to on-demand technological expertise, saving costs for insurers and accelerating time to market.

Cybersecurity and Data Privacy

Delivering insurance in bundled format with other products necessitates the sharing of customer data between platforms and organisations. This makes data security a priority for insurers. The reliance on cloud-based systems to deliver frictionless embedded insurance experiences also makes cybersecurity a prime concern. Ensuring the highest standards of data protection and cybersecurity not only helps build customer trust, but also ensures compliance with data security regulations. It is also important to provide customers with clear information on your privacy policies, including how their data will be collected, stored and used.

Customer Education

Customers might not always understand the terms and conditions or coverage when buying insurance as an add-on to a product purchase. Educating customers, therefore, becomes crucial to preventing any misunderstandings or problems during the claims process. By creating awareness and ensuring transparency, you also ensure customer satisfaction.

Regulatory Compliance

The regulatory landscape is evolving at par with advances in technology and business models. Navigating the complex regulatory environment is already challenging, even without the added complexities of embedded insurance. Partnering with a trusted insurtech provider can provide access to compliant technology solutions and ease the provision of on-demand insurance.

Final Thoughts

Embedded insurance is all set to be the future of the insurance industry. Integrating your products into familiar commercial channels delivers immense customer convenience while fostering trust. With such partnerships, insurance companies in India can leverage the existing brand loyalty of retail platforms to expand their reach and offer on-demand, personalised coverages. This paves the way for insurance to be a more accessible, streamlined and customer-centric experience. Leading insurtech companies in India ease the embedded insurance journey by powering insurers with advanced plug-and-play solutions that support partnerships and drive business success.

Bibliography (Last accessed on September 18, 2024)

https://www.oneinc.com/resources/blog/the-rise-of-embedded-insurance-opportunities-challenges

https://www.financierworldwide.com/embedded-insurance-opportunities-and-risks

https://www.techmahindra.com/insights/views/rise-embedded-insurance-game-changer-insurance-industry/

https://inc42.com/resources/how-embedded-insurance-is-changing-indias-insurtech-landscape/

https://www.rinf.tech/a-comprehensive-guide-to-embedded-insurance/