Globally, written embedded insurance (EI) premiums are forecasted to reach $500 billion by 2030, growing at a CAGR of 25% from 2024 to 2030 and accounting for 20% of the insurance market. A key driver is the shift from traditional points of sale to innovative embedding mechanisms.

Factors Driving the Growth of Embedded Insurance

Two critical factors are fuelling EI growth:

1. A Shift in the Insurance Landscape

The Indian insurance industry caters to two broad segments – the digital urban consumer and the underserved tier-2/3 and rural communities. Within these are smaller segments with distinct needs.

Digital customers prefer the convenience offered by opt-in insurance embedded in purchases. They expect the same seamless experience for claims processes. They are happy to share data so that insurers can serve them better. This further creates cross-selling and up-selling opportunities. Innovative products, such as the digital wallet by Garanteasy, an Italy-based company that allows users to keep all their warranties in one place, are a great way to attract customers.

A key requirement of these customers is the protection of their privacy. Insurance companies in India must assure the end-customer and partner platforms of strong data protection by demonstrating cyber resilience through audits and ensuring compliance through automation.

On the other hand, some consumer segments are more concerned with premium pricing and need education about insurance benefits. Products ranging from electronics to travel and group health insurance have made inroads into previously untapped areas and populations with the help of embedded insurance policies.

2. Insurtech-Powered Technological Transformation

Insurtech companies in India enable insurance providers to respond to the needs and evolving purchase behaviours of diverse customer segments. Technological advancements have opened new pathways for insurers to bundle their products with those of other industries. Open API-based integrations with e-commerce, travel and healthcare platforms, and seamless data exchange enable insurers to identify prospective customers and pitch their offerings during purchase. This significantly reduces distribution costs, as insurers can leverage the customers’ trust in the retailer. They view insurance as a value-added service and not an additional expense. This shift in mindset improves insurance sales while the risk is shared between the distributor and the insurer.

Insurtech companies in India equip insurers with data-driven pricing mechanisms to offer top-of-the-line coverage at competitive premiums. They leverage big data analytics and machine learning-powered modelling approaches to provide deep insights into consumer behaviour, market demand and the competitive landscape. Insurers get to differentiate their brand with personalised offerings distributed via functional digital channels. For instance, embedding insurance with dual-branding benefits the informed digital customer, while selling policies via the retailer’s brand is better in tier-3 areas where merchant trust is high.

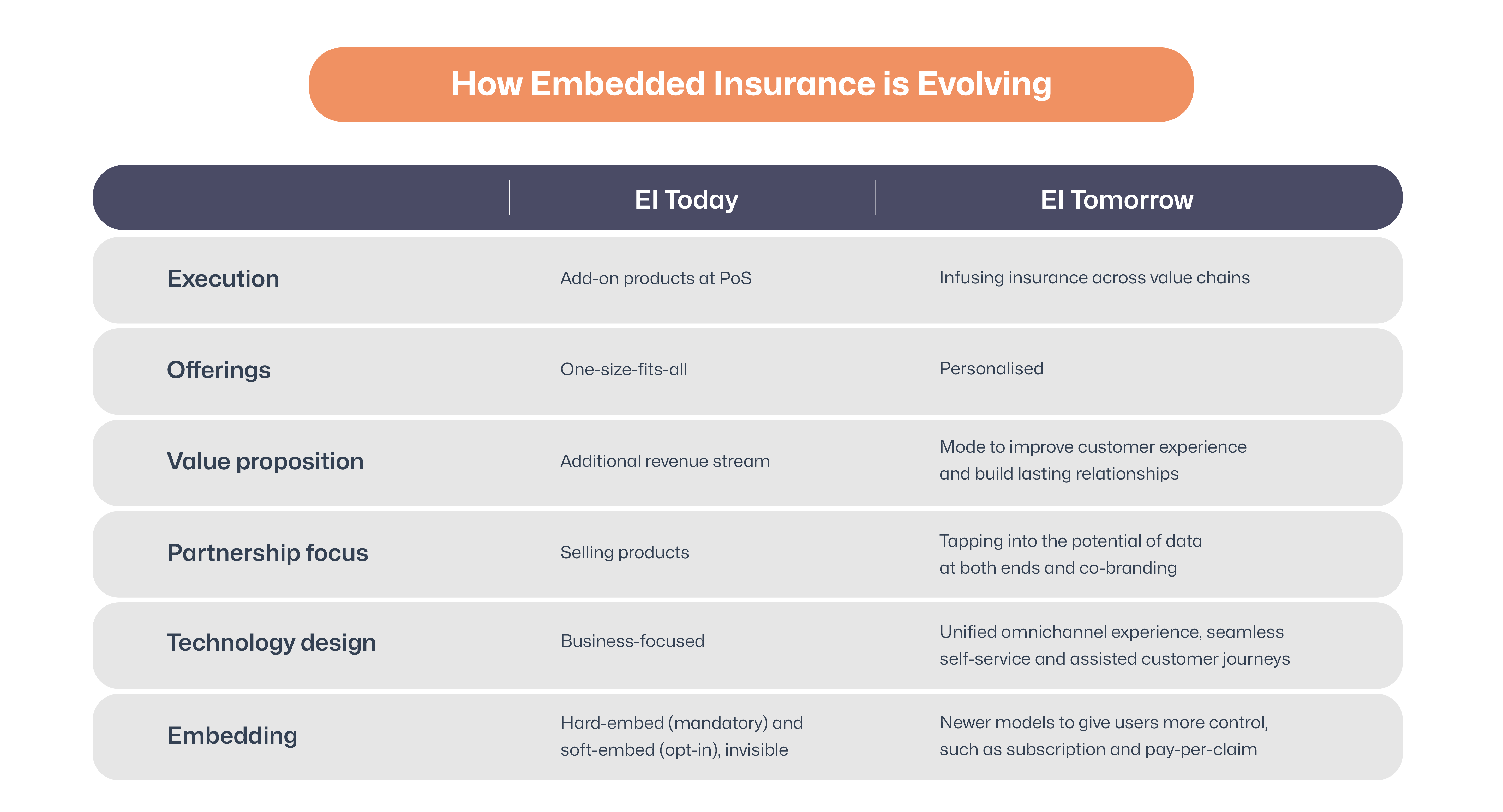

Preparing for the Next Iteration of Embedded Insurance

Embedded insurance has paved the way for insurance companies in India to differentiate themselves from the competition and improve revenues. Key practices to prepare for the long term are:

Tapping into emerging opportunities and boosting conversions through continuous innovations powered by ongoing research and product design models.

Leveraging behavioural studies to identify the appropriate steps in the customer journey to infuse insurance, enhancing policyholder engagement, satisfaction and trust.

Monetising cross-industry data through open ecosystems to enhance capabilities and support partners to grow while reducing risk exposure.

Building multi-channel capabilities to offer unified and personalised experiences for seamless customer discovery, engagement, conversion and retention.

Adopting a compliance-by-design approach to automate compliance checks across partnerships and evolve with the regulatory landscape.

7 Steps to Optimally Utilise Insurance Embedding

Carefully choose the market and prospective partners with good outreach and identify coverage gaps to bundle your offerings.

Create compelling value propositions for prospective partners and end users with customer-centric products.

Develop a branding strategy, either in collaboration with your chosen distributor or for issuing policies through the partner’s brand.

Build agile, modular and scalable technology infrastructure to penetrate newer markets via diverse distribution channels.

Leverage API-based technologies to integrate underwriting and policy issuance into the partner’s sales journey.

Develop seamless claims processes accessible directly through the distributor’s customer grievance portal.

Extract relevant insights from distribution partner and insurance sector data to refine your offerings with evolving customer demands and gain a competitive advantage.

Technology Requirements to Create Embedded Journeys

Top technology imperatives for insurers in India to make the most of embedded insurance include:

Robust PAS

Robust policy administrative systems (PAS) to enable integrations, customisations, and accelerate time to market.

Simple Policy Engine

Straightforward policies with easy-to-understand terms and conditions, even for a layman, to drive applications through simplified engines.

Open Architecture

Open API-based architecture to ease integration with diverse platforms across distribution channels.

Seamless Claims

Resilient and frictionless claims management systems backed by predictive analytics to prepare necessary reserves with informed claims projections.

Customisable User Interfaces

White-label front-end customer and merchant portals with multilingual support to facilitate joint and independent branding.

Embark on a Journey to the Future with Insurtech

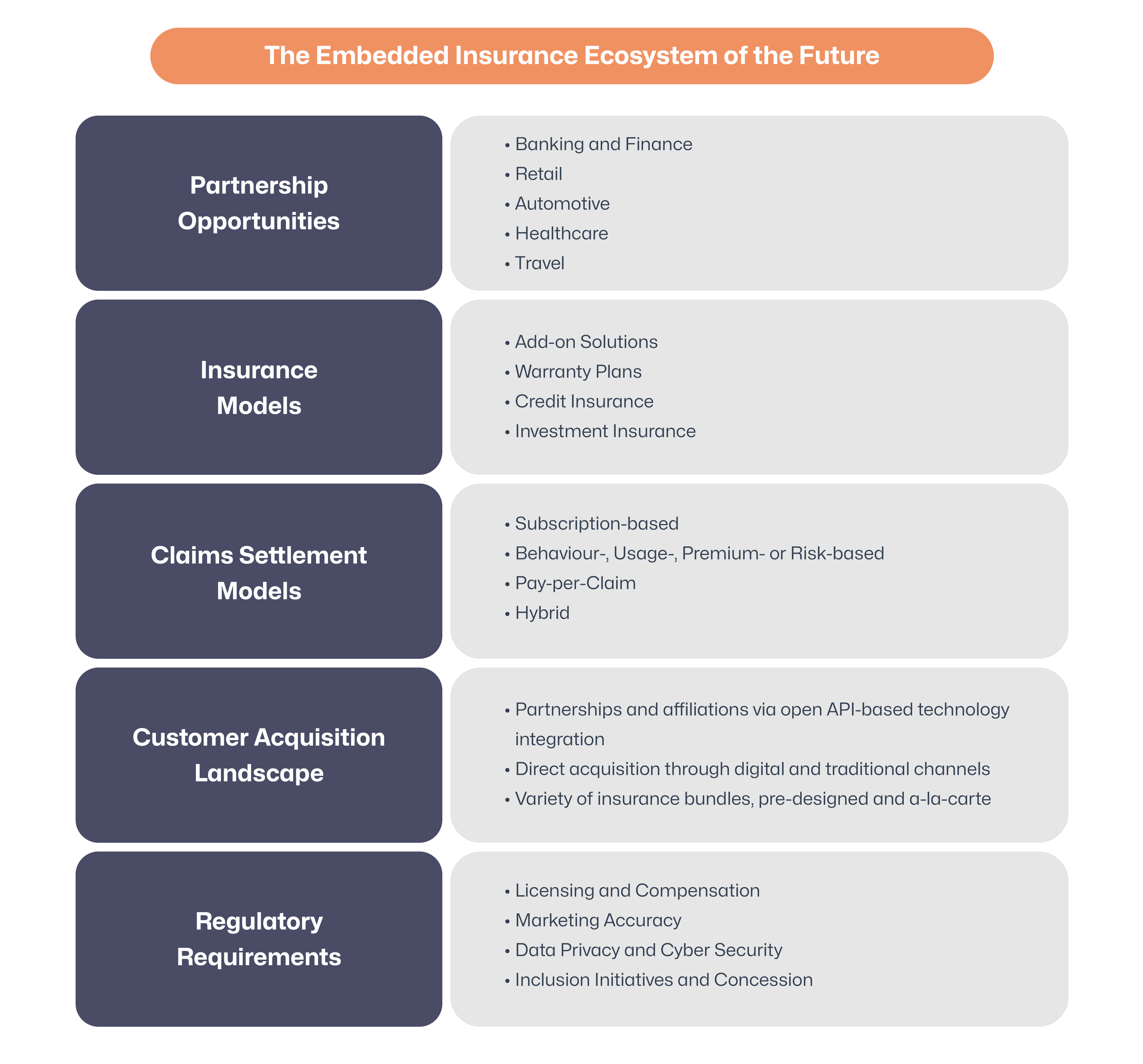

Embedded insurance is set to become an ecosystem that enhances the value of data and technology for all participants and customers. Focusing on making insurance more affordable and accessible while also improving claims processing experiences is crucial for insurance companies in India to grab a more significant market share.

Third-party collaborations through API-based integrations across digital distribution channels enable insurance providers to remain compliant and expand their outreach without the significant impact of technical debt. A key risk of embedded insurance for providers is becoming mere capacity providers for non-insurance partners and, for the industry, a greater commodification of the facility. This may translate into weakened customer relationships. Given the immense potential of the opportunity, being a spectator of the revolution might be business suicide. Therefore, adopting a strategic approach to partnerships and technology integrations is essential.

Insurtech companies in India employ technologies such as AI and no-code and low-code platforms to optimise the value of their collaborations with data intelligence, distribution acceleration and elevated purchase journeys. They power insurance providers with greater agility and scalability to acquire more clients in a rapidly expanding market. Additionally, strategic revenue models that enable profit-sharing with partners and competitive premiums are critical to business growth. Insurtech companies are prepared to empower insurance providers in India with excellence in underwriting, portfolio management and claims verification capabilities.

Bibliography: (Last accessed on October 1, 2024)