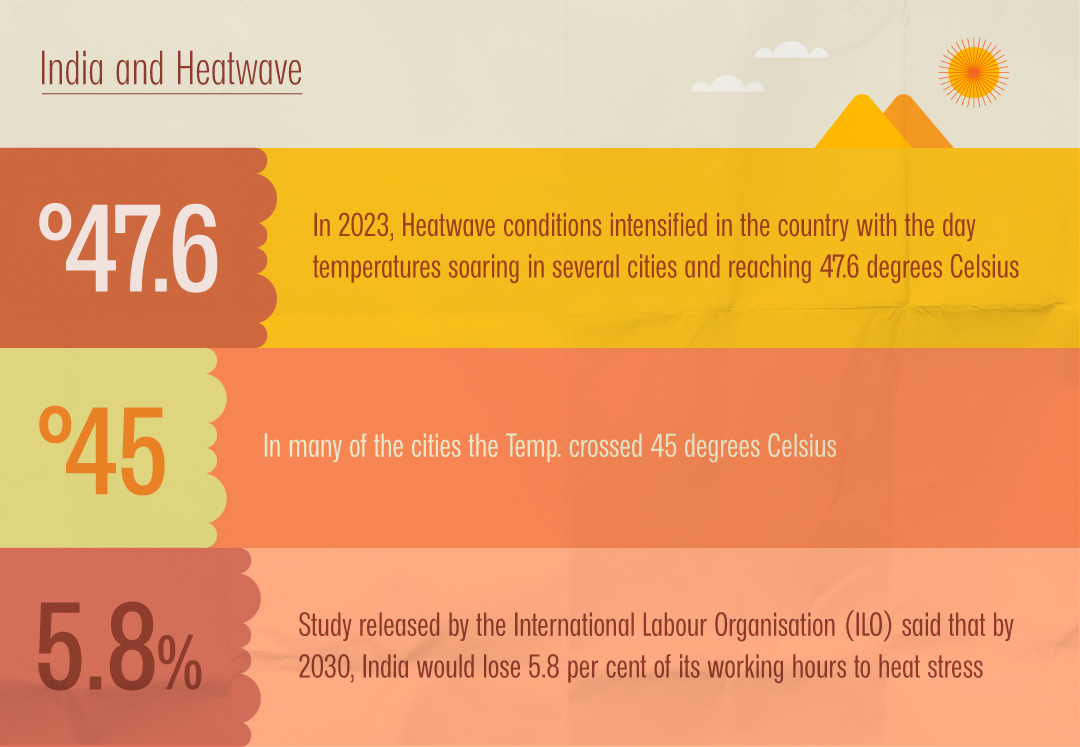

India, with its diverse climate, often experiences extreme temperatures, particularly during the summer months. Heatwaves and high humidity levels can lead to various heat-related illnesses, making it crucial for individuals to understand these conditions and know what health insurance policies cover. The awareness of health risks stemming from heatwave and prolonged exposure to high temperatures remains sadly insufficient. This blog explores common heat-related illnesses, their symptoms, preventive measures, and the extent to which health insurance can support individuals in managing these conditions.

Common Heat-Related Illnesses

Heat Exhaustion

Symptoms: Heavy sweating, weakness, dizziness, nausea, headache, and muscle cramps.

Causes: Prolonged exposure to high temperatures, particularly when combined with high humidity, and physical exertion.

Heat Stroke

Symptoms: High body temperature (104°F or higher), altered mental state, rapid breathing, racing heart rate, and dry skin.

Causes: A severe form of heat illness that occurs when the body fails to regulate its temperature.

Heat Cramps

Symptoms: Painful muscle cramps, usually in the legs or abdomen, often accompanied by heavy sweating.

Causes: Intense physical activity in hot weather leads to significant loss of body salts and fluids.

Heat Rash

Symptoms: Red clusters of small blisters that can cause discomfort and itching.

Causes: Excessive sweating that blocks sweat ducts.

Dehydration

Symptoms: Extreme thirst, dry mouth, dark-coloured urine, dizziness, and fatigue.

Causes: Inadequate fluid intake and excessive loss of fluids through sweating.

Health Insurance Coverage for Heat-Related Illnesses

Health Insurance Coverage for Heat-Related Illnesses

Health insurance in India typically covers a wide range of medical expenses, but it’s essential to understand the specifics regarding heat-related illnesses. Here’s what you should know:

Hospitalisation Costs: If a heat-related illness necessitates hospitalisation, most comprehensive health insurance policies cover the cost of room rent, nursing, and intensive care unit (ICU) charges. This includes treatments for severe conditions like heat stroke.

Doctor Consultations and Treatment: Health insurance policies generally cover consultation fees with general practitioners and specialists. Treatments for heat exhaustion and heat cramps, such as electrolyte administration and intravenous fluids, are also typically covered.

Diagnostic Tests: Policies often cover the cost of diagnostic tests required to assess the severity of heat-related illnesses. This includes blood tests, urine tests, and imaging studies.

Emergency Services: In case of severe heat-related conditions, health insurance policies usually cover ambulance services and emergency care costs.

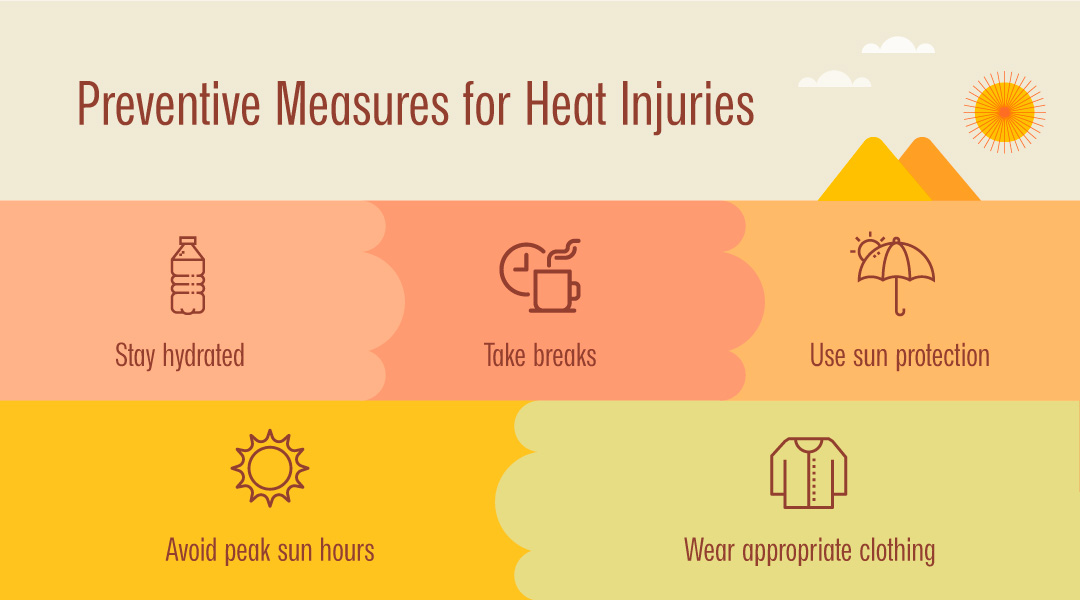

Preventive Health Check-ups: Some health insurance plans offer coverage for preventive health check-ups, which can help in the early detection and management of conditions exacerbated by heat.

Medications: Prescribed medications for treating symptoms of heat-related illnesses are often covered under health insurance policies.

Special Considerations

Pre-existing Conditions: If you have pre-existing conditions that can be aggravated by heat, such as heart disease or diabetes, ensure that your policy covers related complications.

Cashless Treatment: Opt for a policy with a wide network of hospitals offering cashless treatment to avoid the hassle of reimbursements.

Policy Limits: Be aware of the sub-limits and caps on various expenses. Some policies might have a cap on room rent or specific treatments.

Conclusion

Understanding heat-related illnesses and the extent of health insurance coverage is vital for navigating the challenges posed by India's extreme weather conditions. By staying informed about your health insurance policy details and taking preventive measures, you can ensure better preparedness and protection against the adverse effects of heat. Always read the fine print of your policy and consult with your insurance provider to understand the specific coverages and benefits available to you. Stay safe and protected, especially during the sweltering summer months.