The insurance industry has traditionally been known for its extensive paperwork, lengthy processing times, and manual interventions. However, with the advent of Artificial Intelligence (AI) and automation, the landscape of claims processing is undergoing a significant shift. These technological advancements are not only streamlining operations but also enhancing accuracy, reducing costs, and improving customer satisfaction. If the India Brand Equity Foundation is to be believed, there are attractive opportunities in the nation’s near future, like:

The insurance market in India is expected to reach US$ 222 billion by 2026.

Robotic Process Automation (RPA) and AI will occupy centre stage in insurance, driven by newer data channels, better data processing capabilities and advancements in AI algorithms.

Bots will become mainstream in both the front and back office to automate policy servicing and claims management for faster and more personalised customer service.

But first, let’s understand the difference between the traditional claims model and AI/Automation-compatible claims model.

Traditional Claims Processing vs Advent of AI and Automation

Claims in a paradox of the insurance industry. While neither the policyholder nor the insurer wants it to happen, when it does it becomes vital for both parties. Historically, claims processing is known to be a tedious process involving extensive paperwork and data analysis lasting months on end. The traditional claim process usually comprises a series of manual steps: collecting information from the claimant, verifying the details, assessing the damage or loss, determining the compensation, and finally, disbursing the payment.

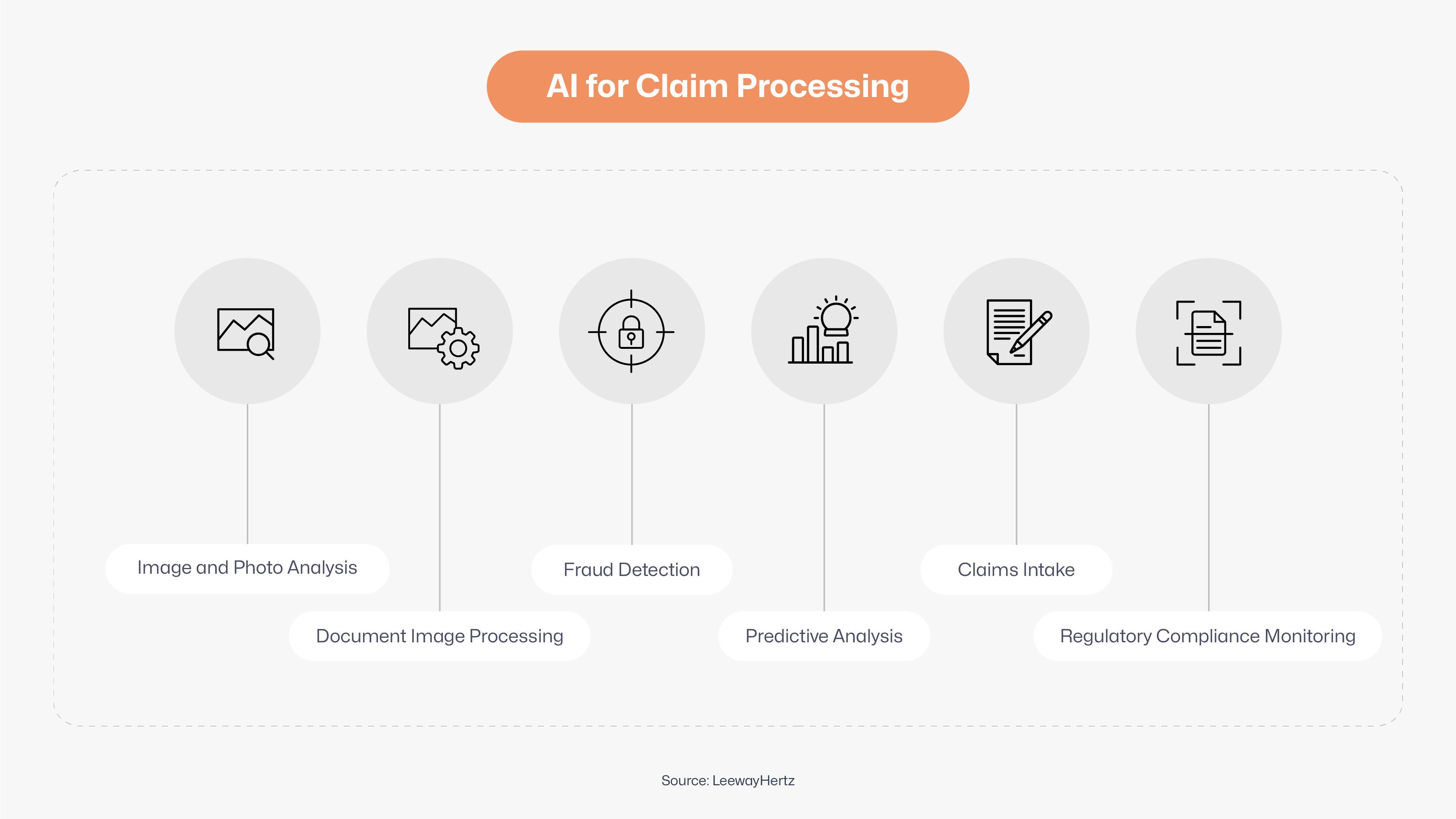

With the advent of AI and automation, the claims process has undergone a huge transformation. AI and automation are revolutionising this traditional model by introducing efficiency, speed, and accuracy into the claims process. These technologies are being integrated at various stages of claims management, from initial reporting to final settlement. The outcome?

Accelerated claims processing

Increased throughput and accuracy

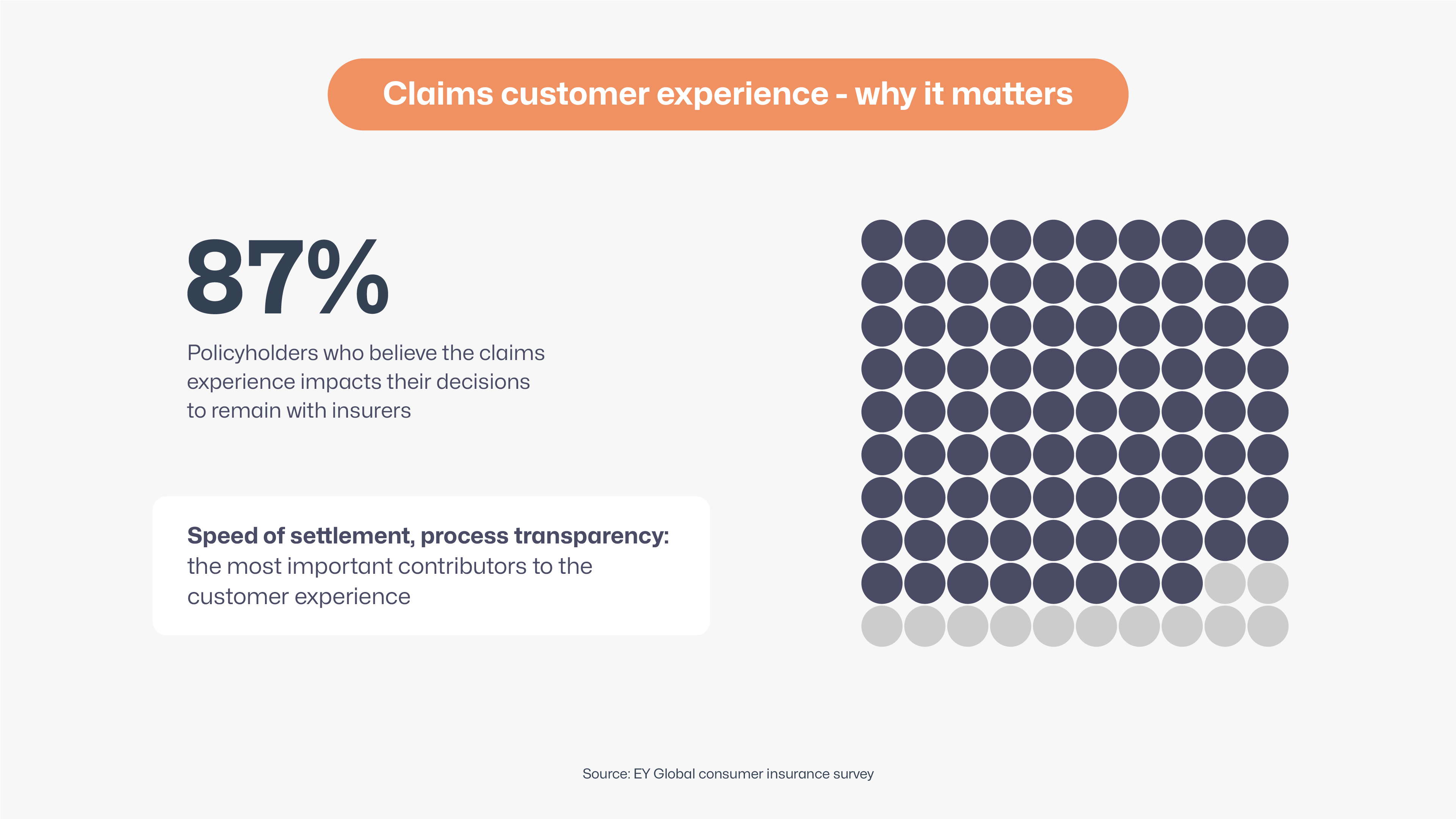

Better customer experience

Real-World Examples

Real-World Examples

Several insurance companies have already embraced AI and automation to enhance their claims processing operations:

A leading digital insurer uses AI to handle claims efficiently. Their AI chatbot, processes claims in real-time, with the fastest claim being settled in just three seconds. This level of efficiency has set a new benchmark in the industry.

A global financial services provider has implemented AI-driven solutions for claims processing, which have reduced the processing time for simple claims from several days to just a few hours. Their AI system can process up to 60% of claims without human intervention.

One of the world’s largest insurers leverages machine learning and AI to predict the cost and complexity of claims. Their system analyses data from previous claims to provide accurate estimates and streamline the processing workflow.

Conclusion

The evolution of claims processing with AI and automation is transforming the insurance industry. These technologies are enhancing efficiency, reducing costs, and improving customer experiences. As AI continues to advance, the future of claims processing looks promising, with even greater innovations on the horizon. Embracing these changes will be crucial for insurers aiming to stay competitive in a rapidly evolving market.

The evolution of claims processing with AI and automation is transforming the insurance industry. These technologies are enhancing efficiency, reducing costs, and improving customer experiences. As AI continues to advance, the future of claims processing looks promising, with even greater innovations on the horizon. Embracing these changes will be crucial for insurers aiming to stay competitive in a rapidly evolving market.