This is a period of rapid and significant changes for the insurance industry, at the global and local levels. Insurance companies that fail to keep up with the pace of change are doomed to be left behind in the race. Unfortunately, the insurance sector has never been known to be a frontrunner in adopting disruptive models. Yet, the world today is characterised by new entrants, powered by technological advancements, giving incumbents a run for their money.

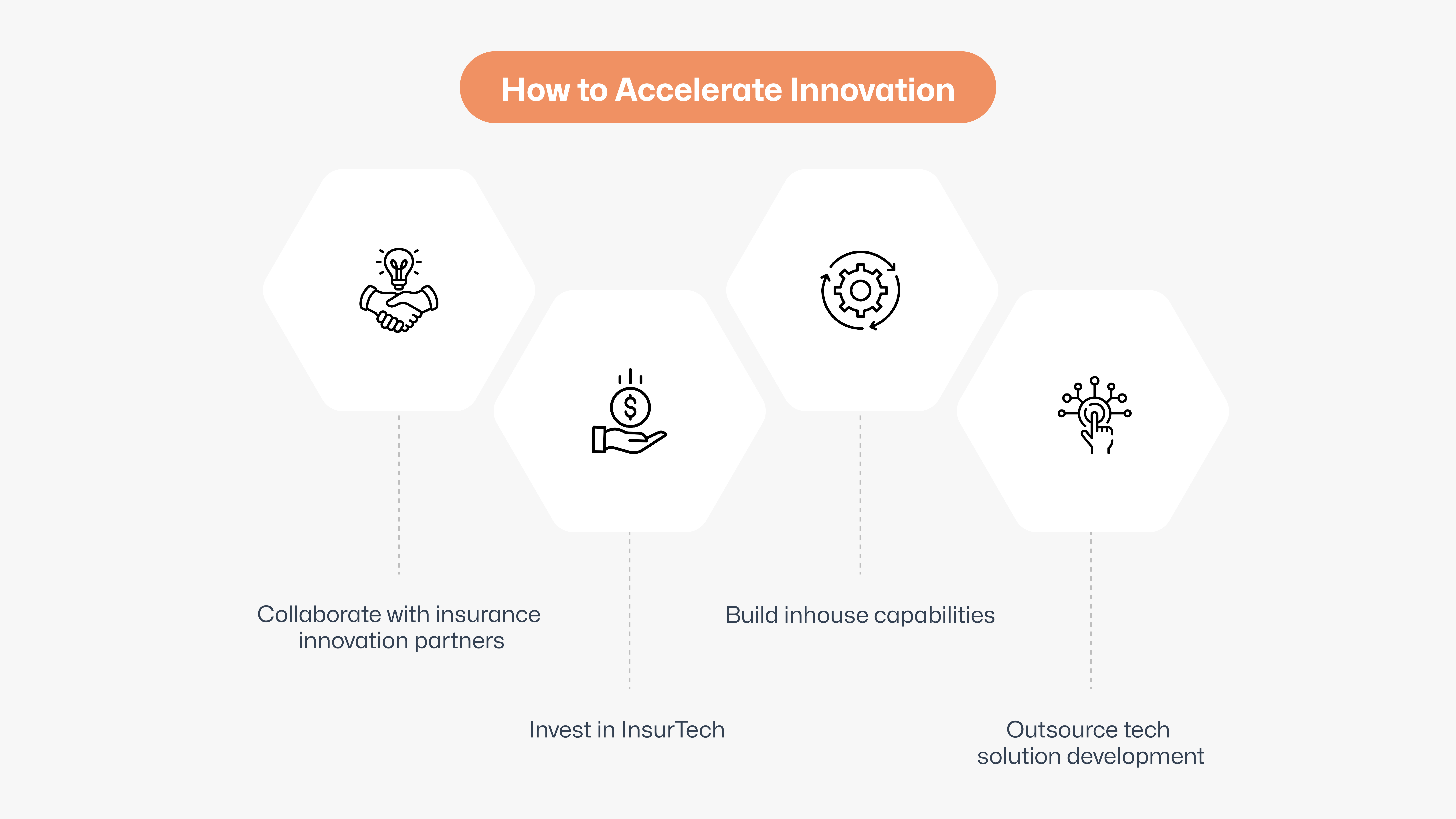

The time now is for insurance companies in India and the rest of the world to adopt enabling technology and forge strategic partnerships with InsurTech solutions providers to deliver holistic value propositions and establish deeper and more meaningful relationships with customers, especially the underserved populations. Anticipating and adapting to emerging market demands with agility is now the most efficient way to remain relevant and a step ahead of the competition.

“As ever, customers dictate the future of the industry. Their needs, objectives and even aspirations should inform and inspire the growth strategies and innovation agenda for all industry stakeholders.” - EY

However, new opportunities also bring fresh and more complex risks. So, how can the insurance sector transform from being tech laggards to innovators? Here’s a look.

Why Innovation is the Key to Growth for the Insurance Sector?

Innovation in the insurance sector in India goes much beyond adopting the latest technology. It is about reimaging customer experiences, business processes and models – finding unique solutions to age-old problems and capitalising on the emerging trends to reinvent insurance. In fact, the insurance industry is increasingly seeing innovation as critical to success, with 90% of insurance providers worldwide intending to increase investment in AI in 2024.

Innovation is the only way to remain relevant in an ever-evolving market. The end-user’s perspective is constantly changing with the increasing penetration of the internet and smartphone even in the remotest parts of the world. In the age of democratised access to information, consumers expect transparency, control and convenience. Leveraging insurance technology is the best way to not just fulfil customer expectations but also to predict their needs proactively. Brands that respond quickly to emerging needs gain the first-mover advantage.

Technological innovations have given insurance companies in India the power of big data. Data analytics has not just transformed risk assessment and identification of new markets but also provided insights to redefine business models. InsurTech is providing access to data from multiple sources, including social media chatter, to help innovate and personalise offerings. On the other hand, AI/ML has revolutionised customer interactions and underwriting. At the same time, cloud computing has given the power of scalability.

However, to reap the long-term benefits, innovation needs to become part of the DNA of insurers.

Building a Culture of Innovation

Building a Culture of Innovation

To truly leverage its power, innovation needs to be a company-wide endeavour. Here are some ways to build an innovative mindset across the organisation.

Move Resources to Innovation Initiatives

Novel ideas cannot emerge in a vacuum. You need to first identify untapped markets and needs. This will give you insights into how best to address them. The next step is to test solutions and business models for these markets and needs. However, entering unchartered territory without sufficient resources, including manpower, management focus and assets, amplifies risks. Therefore, if you want to innovate, you must support it with adequate financial resources and talent.

By doing so, you can take care of business as usual, without disrupting existing systems or operations, while, simultaneously, testing new offerings and business models that might re-balance your product portfolio for stronger growth and expansion.

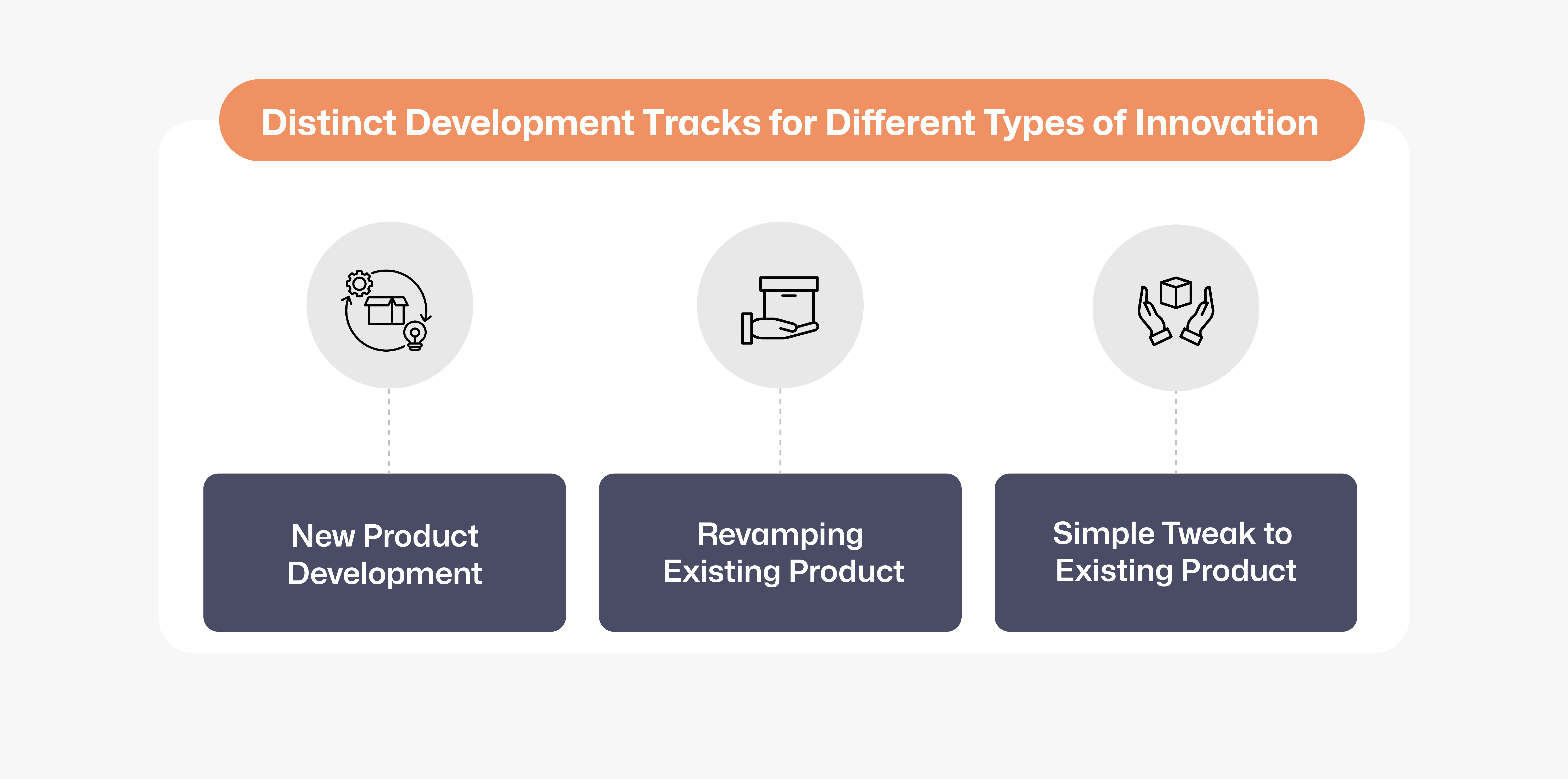

Implement Distinct Product Development Processes and Pathways

Different innovation projects might need distinctive approaches. For instance, most insurance companies in India and the rest of the world can predict the potential gain in total written premiums from improving an existing policy or tweaking a core process. This insight gives clarity regarding possible risks and how to overcome them. But such innovation is very different from building and launching a unique, disruptive product, such as a brand-new life insurance policy that offers amazing flexibility over living benefits.

New, disruptive products come with their share of risks, which insurers tend to have lesser clarity on. A key example of this was the rise and rapid decline of mutual-aid platforms in China. In 2019, numerous such platforms were launched, providing easy access to basic health insurance. It represented a radical shift in product design. Ant Financial’s Xiang Hu Bao was perhaps the most successful of these platforms, garnering over 100 million users within a year of its launch. However, these initiatives started winding down just as quickly as they had arisen due to increasing regulatory oversight and errors in customer selection, with young and healthy users abandoning the platforms. The result was that the remaining participants had to bear increasing costs.

This highlights the importance of creating distinct pathways to develop each product. Also, each pathway should be characterised by:

Market and risk analysis

Identifying the best-suited technology solutions

Facilitating collaboration between business units

Managing change effectively

Plus, the pathways must be created based on the type of development track required. This will be determined by the extent of innovation you are seeking.

With support from InsurTech companies in India, you can access tools to analyse each product’s economics and probability of success. This will determine which products need redesigning and which can be coupled with another product to offer a value-add to consumers. For example, you could embed annuity or similar guaranteed-income options in a unit-linked insurance plan (ULIP). Risk/reward profiles can also inform product development pathways.

With support from InsurTech companies in India, you can access tools to analyse each product’s economics and probability of success. This will determine which products need redesigning and which can be coupled with another product to offer a value-add to consumers. For example, you could embed annuity or similar guaranteed-income options in a unit-linked insurance plan (ULIP). Risk/reward profiles can also inform product development pathways.

Make Innovation an Integrated, Continuous Process

One of the primary reasons for the failure of innovation initiatives is that insurers fail to fully integrate it into their business planning cycle. This failure to integrate often leads to a lack of clarity on near-term and long-term success metrics. There is a lack of common understanding across teams regarding how the success of innovation will drive the success of a business vertical and the entire organisation. Innovation teams will, therefore, not see themselves as an integral part of the long-term vision. Similarly, other business units might not feel as committed to implementing and scaling the innovative products.

Also, fostering communication between innovation and other business teams can facilitate a common understanding of the market opportunities, while driving collaborative strategic planning. For example, the innovation team can identify new product opportunities based on testing with end-users and distribution partners. This helps them build a pipeline of target opportunities that can be converted into detailed product ideas.

Innovation teams can then develop business cases for each product concept, detailing the basis for the estimated value the offering is expected to deliver. Such business cases can be used to list risk scenarios that can be tested. The information gained through this testing can be used to refine product concepts and establish clear milestones for the development roadmap. If testing reveals the likelihood of failure for the product idea, efforts and resources can be quickly and efficiently refocused.

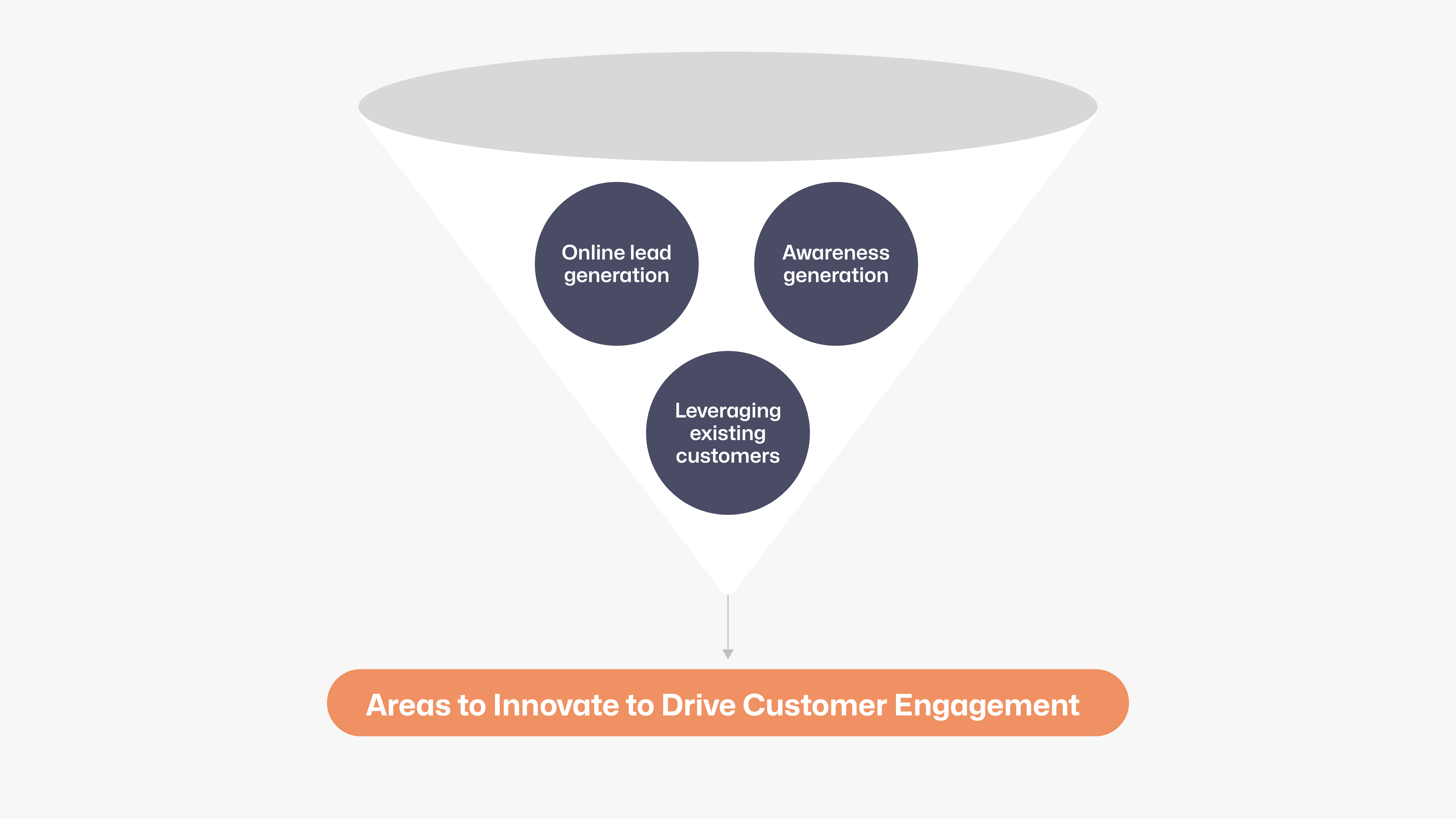

Innovate Approaches to Engage Customers

Innovation isn't limited to developing new value propositions for products. It should also focus on marketing and distribution. An amazing new product will only give justified returns when its value is understood by the end-user. This is especially important, given the evolving customer expectations, where hyper-personalisation, immense flexibility and complete convenience are fast becoming the norm.

To engage new and existing customers, you first need a more granular understanding of customer profiles across different markets. This will help you tailor your messaging for maximum impact. In addition, an omnichannel approach is rapidly becoming indispensable to capturing and holding onto customer attention. For instance, 64% of customers expect brands to connect with them on social media, while 70% feel more connected to businesses whose CEOs are active on social media.

Spur Innovation with the Right InsurTech Partner

Spur Innovation with the Right InsurTech Partner

The time now is for insurance companies in India to partner with a skilled and experienced InsurTech provider like Zopper to enhance the quality, breadth and pace of innovation. Given that customer expectations and market dynamics are evolving, delivering consumer-centric and personalised products is the need of the hour. Insights regarding what constitutes such a product for your target market can be best supported by tech solutions for AI/ML-powered data analytics. Technology tools can also accelerate innovation while easing change management within the organisation. So, choose your partner carefully to integrate innovation within the DNA of your business.

"The current mood is about reinventing, and new players and incumbents are working jointly on it. I think this collaborative approach will be game changing." - Jörg Mußhoff, Senior Partner and Coleader of Insurance Practice, McKinsey

Bibliography

https://www.ey.com/en_uk/insurance/how-life-insurers-are-transforming-to-deliver-value-for-better-living (last accessed on August 8, 2024)

https://appinventiv.com/blog/innovation-in-insurance-enterprises/ (last accessed on August 8, 2024)

https://www.mckinsey.com/industries/financial-services/our-insights/five-steps-to-improve-innovation-in-the-insurance-industry (last accessed on August 8, 2024)

https://insideainews.com/2024/02/03/survey-shows-that-more-than-90-of-insurers-plan-to-increase-ai-investment-top-4-trends-for-insurers-in-2024/ (last accessed on August 8, 2024)

https://sproutsocial.com/insights/data/social-media-connection/ (last accessed on August 8, 2024)

https://insideainews.com/2024/02/03/survey-shows-that-more-than-90-of-insurers-plan-to-increase-ai-investment-top-4-trends-for-insurers-in-2024/ (last accessed on August 8, 2024)

https://www.scmp.com/business/companies/article/3039554/ant-financials-mutual-aid-platform-xiang-hu-bao-attracts-100 (last accessed on August 8, 2024)

https://sproutsocial.com/insights/data/social-media-connection/ (last accessed on August 8, 2024)