In a country like India, with a massive geographical spread, insurance distribution poses various challenges. Rural areas differ significantly from urban regions in customer preferences, needs and purchasing power. While traditional distribution channels still play a crucial role, insurance companies in India are increasingly exploring digital channels to widen their reach. They are partnering with insurtech providers to leverage the latest technology to develop intuitive mobile apps that make insurance products accessible and inclusive.

In fact, mobile distribution channels have emerged as game changers for the insurance industry, bridging the gap between insurers, policyholders, and seekers. But along with the benefits they bring, mobile channels also present challenges that need to be overcome to capitalise on emerging opportunities.

Benefits of Mobile Distribution for Insurance Companies

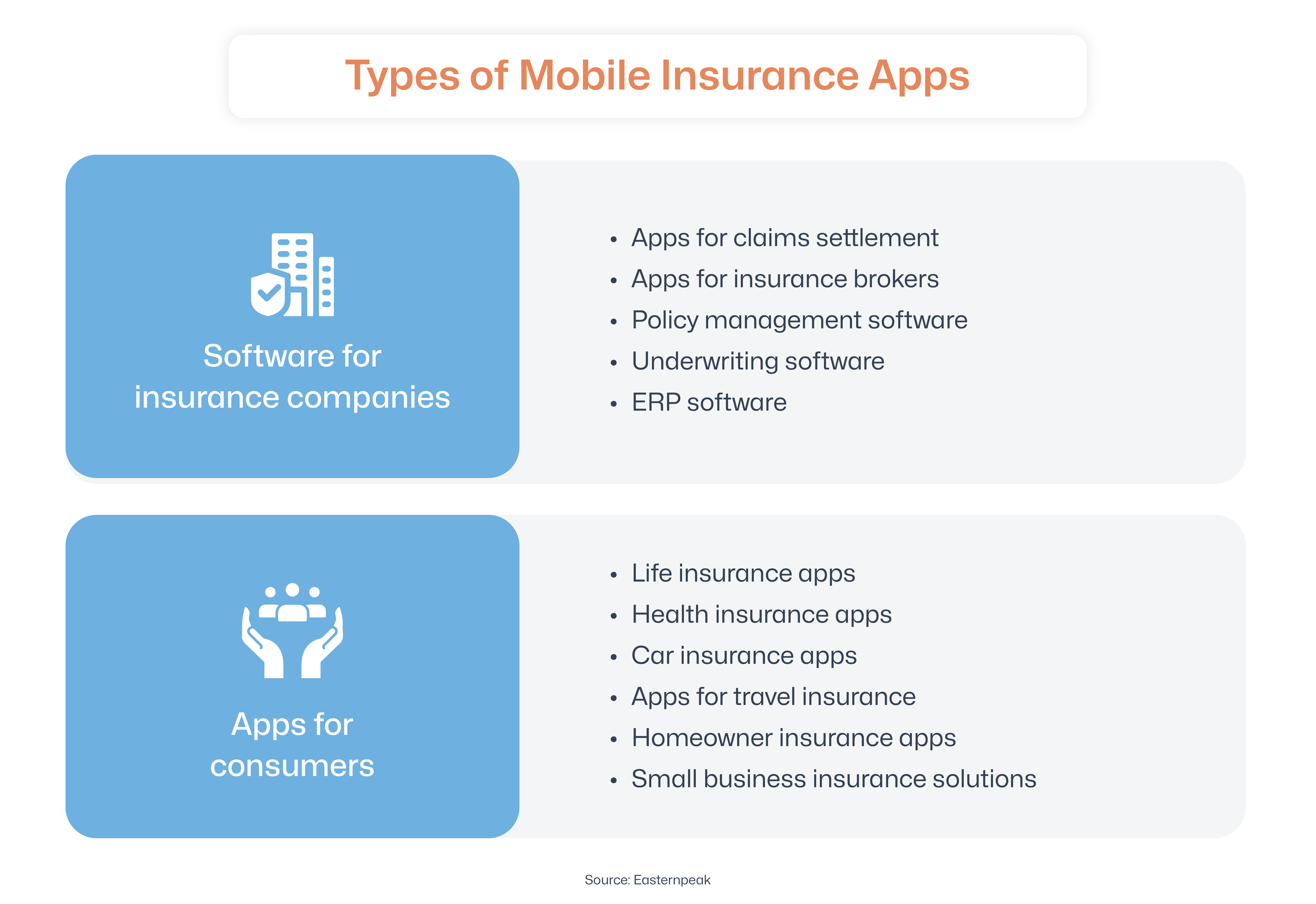

According to a 2023 Gartner survey, the focus of insurers worldwide is shifting from driving revenue to enhancing operational efficiency and customer experience. Against this backdrop, the global insurance industry is expected to invest $322 billion in IT for mobile app development, emerging technologies, automation and more. Insurance companies in India are also rethinking their operational styles, business models and distribution channels to remain relevant for the huge population of digital natives in the country.

Apart from streamlining processes and reducing operational expenses, the opportunities mobile channels present specifically for insurers include:

Data-Driven Decisions

Insurtech and other third-party partnerships that are a part of using mobile distribution channels give insurance companies access to valuable data regarding customer behaviours, spending patterns, needs and preferences. Data from disparate sources can be collated and analysed to extract meaningful insights for strategic decision-making. Such data-based insights help personalise products and services, discover untapped markets and develop new products.

Personalised Offerings

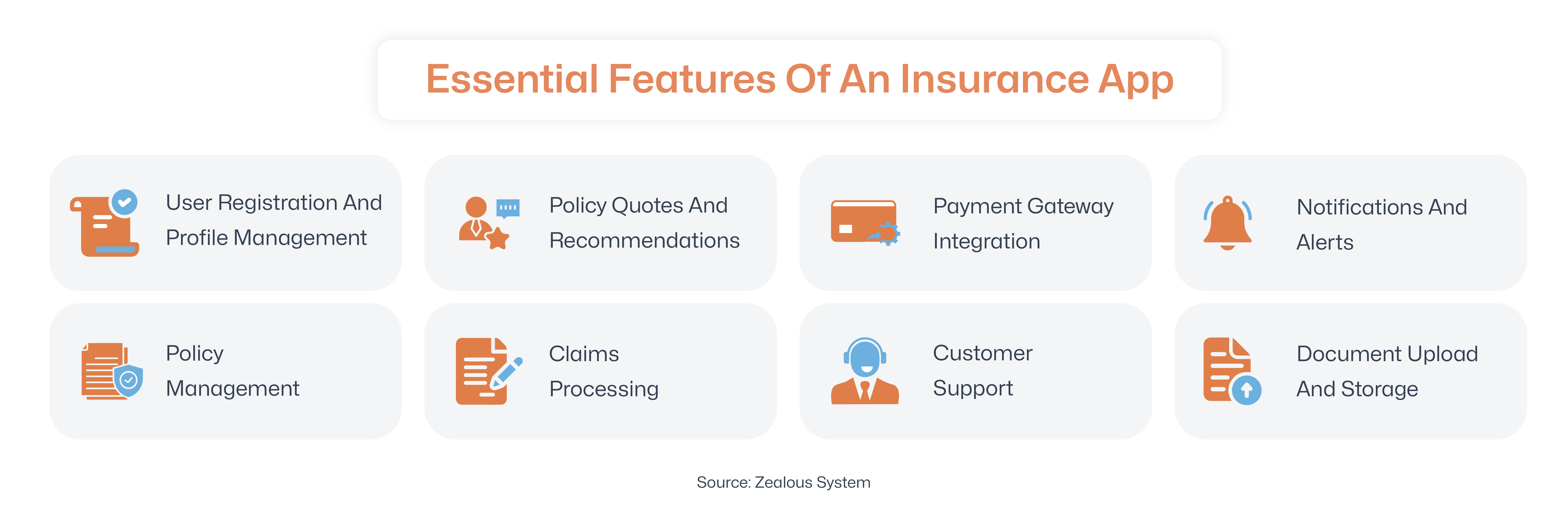

With growing digitalisation across industries, customer expectations are rapidly evolving. Today, customers don’t hesitate to move from one brand to another in search of more personalised experiences. Mobile apps enable insurers to offer personalised customer support, product recommendations, timely alerts and notifications and much more. The result is higher customer satisfaction and rising potential sales.

Better Customer Communication

Mobile channels open up a direct line of communication with customers. AI-powered virtual assistants offer 24/7 support, responding to customer queries in real-time and reducing the burden on human customer service staff. These human representatives can then use their time to offer value-added services and support. Plus, customers can provide instant feedback with mobile apps. Such feedback is critical for insurers to address issues and improve their products and services. Responding to customer feedback also projects the brand as one that listens to its customers and cares about them.

Enhanced Productivity and Sales

Automating a variety of manual tasks, such as generating quotes and processing claims, leads to efficiency gains while reducing the chances of human error. Mobile platforms also arm insurance agents with the right tools to efficiently close deals and manage policies and claims. With mobile distribution channels, insurance applications can be processed almost instantly, accelerating deal closures and reducing customer acquisition costs. Streamlined operations enhance productivity and free up time that can be spent on adding value for the customer.

To reap all these benefits, insurance companies in India must consider migrating from their legacy business models that introduce delays in responding to customer needs and innovating.

Benefits of Mobile Insurance Distribution for Customers

Today’s customers expect seamless experiences with on-demand access to information, products and services. To win and retain customers, insurers must ensure easy accessibility across digital channels, especially mobile phones. There were an estimated 1.01 billion smartphone users in India in 2023, a number that is expected to rise to 1.14 billion by 2025, representing 78.4% of the population. This highlights the need for insurance providers to take a mobile-first approach to their distribution strategy.

With mobile distribution, insurers can offer their customers benefits such as:

Easy access to insurance services and products without the need to visit physical branches or wait in queues.

E-verification of KYC documents eliminates the need for extensive paperwork. Customers can instantly check their eligibility for different policies, learn about the coverage options, understand premiums and make informed decisions.

Instant support can be provided via AI-powered chatbots. Customers can also seek virtual consultations with an experienced insurance agent to understand policy details and receive professional guidance.

Customers gain greater control over policy management with the ability to pay premiums, renew policies and make changes, such as adding riders, at their fingertips. Mobile apps offer custom dashboards for customers to effortlessly manage their policies.

Push notifications and alerts ensure that customers never miss a premium due date and have information about the insurer’s latest offerings, policy updates, terms and conditions, discounts and benefits.

Local assistance can be provided by connecting customers to their nearest branch or agent.

By offering customers all these benefits, along with enhanced inclusivity and accessibility, insurance companies in India can widen their reach and grow their revenue. However, to do so, they first need to overcome the challenges posed by the shift to mobile insurance distribution channels.

By offering customers all these benefits, along with enhanced inclusivity and accessibility, insurance companies in India can widen their reach and grow their revenue. However, to do so, they first need to overcome the challenges posed by the shift to mobile insurance distribution channels.

Challenges Posed by Mobile Insurance Distribution

Adding mobile distribution channels entails added initial costs for insurance companies. While this might seem like a deterrent, the initial investment will more than pay for itself through the plethora of benefits it will bring. Here’s a look at some of the other challenges insurers need to overcome to optimise their mobile distribution strategy.

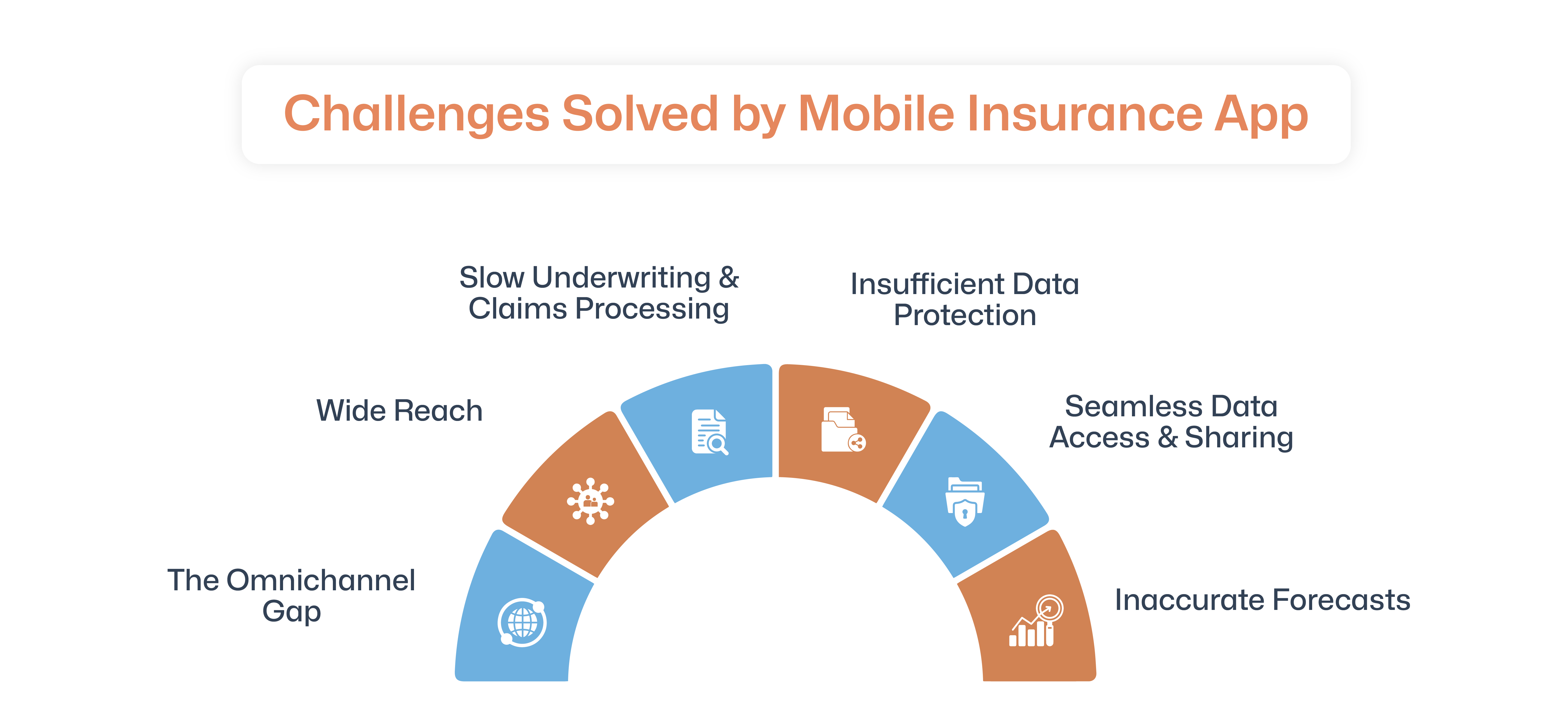

Data Security and Compliance

As digitalisation continues to take precedence, the regulatory framework to ensure the safety of customer data is also evolving. Plus, digital distribution increases cybersecurity risks, such as phishing. Therefore, safeguarding customers' sensitive data and putting in place strong security measures is crucial for insurers choosing mobile distribution for their products and services.

Channel Fragmentation

Adding a new touchpoint increases the need to deliver consistent customer experiences across channels. Seamless data sharing across these channels can ensure that customers do not have to waste time and energy inputting all their information before they can access products and services. Inconsistent experiences and the need to repeatedly provide the same information result in customer dissatisfaction. In addition, insurers need to ensure clear audit trails across distribution channels.

Legacy Systems

Adding innovative solutions to legacy systems leads to inefficiencies, problems with interoperability and added complexities. It is important to migrate to customisable, flexible and scalable technology platform that future-proofs the business. Legacy systems also tend to lack application programming interfaces (APIs) that allow smooth integrations and data exchange. Migrating to a modern platform will help overcome all these challenges.

Digital Agility

Insurers must become more agile and efficient to keep up with the changing insurance market. The need for agility isn’t limited to just one vertical or specific products and services. To deliver agile customer experiences and stay a step ahead of the competition, an effective digital transformation is crucial. This is where partnering with leading insurtech providers can ease the transition for insurance companies in India.

A Connected Ecosystem

To keep pace with the speed of change, insurers must create a connected ecosystem that delivers memorable experiences for everyone, from employees to customers and business partners. The insurance sector has been slow to embrace the digital change. It is important to change this perception by creating solutions that offer consistent customer experiences across multiple touchpoints, including the website, mobile insurance distribution channels, emails and physical locations.

Meeting Customer Expectations

Staying a step ahead of customer expectations and giving them what they need even before they realise they need it isn’t an impossible task anymore. With the availability of real-time and predictive analytics, insurers can meet current customer expectations, such as 24/7 availability, real-time access to products and services, and on-demand policy initiation and pricing. In addition, they can prepare for emerging needs and demands.

Customer Education

While a large percentage of the Indian population is digital-savvy and expects to access products and services online, there still is a need to build awareness about mobile apps, security measures, digital applications for policies and more. This requires targeted marketing efforts and educational initiatives.

Partner with the Right Insurtech Company to Reap the Benefits of Mobile Distribution

Developing and maintaining mobile apps in-house is not just resource-intensive but also delays the time-to-market. Leading insurtech solutions providers offer proven technology tools and expert support to ensure that adding distribution channels and migrating to new technologies for insurance companies is quick, seamless and with minimal disruptions. Due to their wide experience and deep market insights, they can also guide insurers regarding the best options and routes to modernisation.

Bibliography (Last accessed on October 1, 2024)

https://www.prismetric.com/insurance-app-development-benefits/

https://margcompusoft.com/m/navigating-the-complexities/#Distribution_Challenges

https://www.linkedin.com/pulse/challenges-implementing-e-apps-insurance-2024-vijaya-krishna-ksu7c/

https://www.statista.com/statistics/269487/top-5-india-smartphone-vendor

https://www.zealousys.com/blog/insurance-mobile-app-development/

https://www.liferay.com/blog/customer-experience/4-challenges-in-moving-to-digital-insurance