“My son wants to do MBBS. What will it cost me?”

“Sir, Do you want him to study in India or Russia? MBBS in India costs anywhere between ₹65 Lac to 1 Crore. Russia is the slightly cheaper option for you. This college in Kursk is great and it will cost you 25 Lac approximately.”

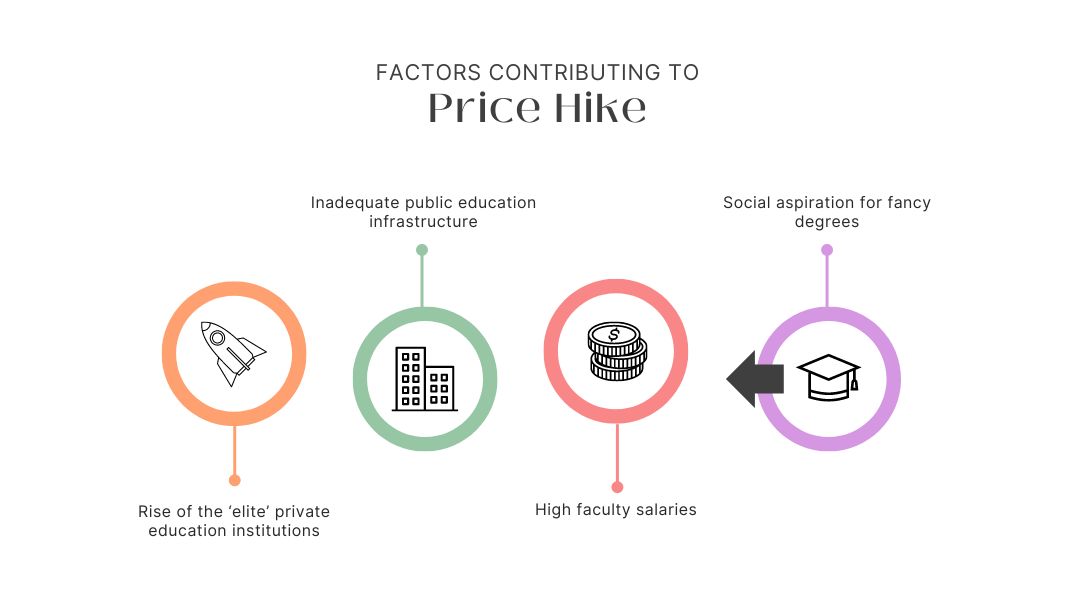

This snippet of a conversation between a father and an admission counsellor gives you a glimpse into the world of education in India. The reality is much starker. Depleted family vaults, crippling education loans and donation-based admissions often act as barriers for deserving students. You would find this interesting to know that as of March 2023, the Consumer Price Index (CPI) for education in India stood at 175, reflecting a surge of approximately 75 per cent since 2012. Additionally, according to a study conducted in 2019, families in India allocate up to 30% of their income towards education expenses, frequently resorting to loans and sacrificing other essential expenditures. Seeing the rapidly rising education costs, families are increasingly turning to insurance solutions to safeguard their children’s academic aspirations. Before delving into the insurance aspect, let’s take a gander of the education landscape first.

The Landscape of Education In India

India boasts a diverse and expansive education landscape, with many schooling options available, including private schools, international schools, and specialised educational institutions. However, alongside the diversity of educational opportunities comes a significant financial burden.

A report from a leading daily provided an outline of the cost escalation in education, such as a two-year MBA program at a leading business school. The program, priced at ₹3 Lac in 2003, surged to approximately ₹16.6 Lac in 2013 and further to ₹24.6 Lac in 2023, reflecting an annual inflation rate of 11 per cent over 20 years.

The impact - a higher dropout rate. As per data from the National University of Educational Planning and Administration (NUEPA), the dropout rate for higher education in India stands at 25 per cent. There are several reasons attesting to it but the most obvious one is the inability to afford college tuition fees and living expenses.

The impact - a higher dropout rate. As per data from the National University of Educational Planning and Administration (NUEPA), the dropout rate for higher education in India stands at 25 per cent. There are several reasons attesting to it but the most obvious one is the inability to afford college tuition fees and living expenses.

Understanding The Risks

The education journey is fraught with risks that can derail a child's progress. Health emergencies, accidents, and unexpected financial setbacks can disrupt a family's ability to provide quality education for their children. According to a survey, health shocks are one of the leading causes of financial distress for Indian households, with education expenses often taking a backseat in times of crisis.

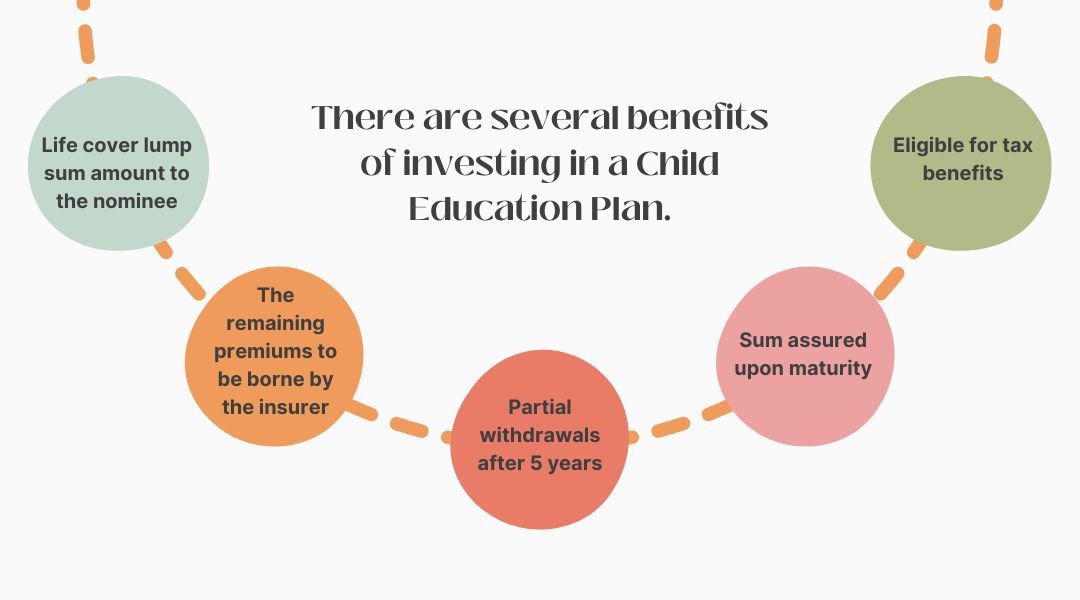

Insurance plays a crucial role in mitigating these risks and ensuring continuity in a child's education journey. Insurance solutions such as child education plans and savings-oriented policies help parents build a corpus for their child's future educational expenses. These plans offer long-term savings and investment benefits, allowing parents to accumulate funds gradually over time to meet their child's educational needs.

Primary to Higher Education

As children progress through primary and secondary education, the costs associated with schooling, tuition fees, extracurricular activities, and educational materials continue to rise.

The cost of education becomes even higher when the child reaches college age. With rising tuition fees, living expenses, and the potential for studying abroad, funding a child's higher education requires careful financial planning. Education loans and specialised education insurance policies cater to these needs, providing financial assistance for college tuition, hostel fees, travel expenses, and other related costs. Moreover, Unit-linked Insurance Plans (ULIPs) offer investment opportunities with the flexibility to tailor investment strategies to meet educational goals, ensuring a secure financial future for the child. Depending on your return appetite, you could also consider investing in Child Endowment Plans and Moneyback Insurance Plans.

The cost of education becomes even higher when the child reaches college age. With rising tuition fees, living expenses, and the potential for studying abroad, funding a child's higher education requires careful financial planning. Education loans and specialised education insurance policies cater to these needs, providing financial assistance for college tuition, hostel fees, travel expenses, and other related costs. Moreover, Unit-linked Insurance Plans (ULIPs) offer investment opportunities with the flexibility to tailor investment strategies to meet educational goals, ensuring a secure financial future for the child. Depending on your return appetite, you could also consider investing in Child Endowment Plans and Moneyback Insurance Plans.

Conclusion

By providing financial protection against health risks, unforeseen emergencies, and educational expenses, insurance products empower families to secure their children's educational aspirations and build a brighter future. As education costs continue to rise, integrating insurance solutions into the education journey is essential for ensuring access to quality education and fostering socio-economic development in India.