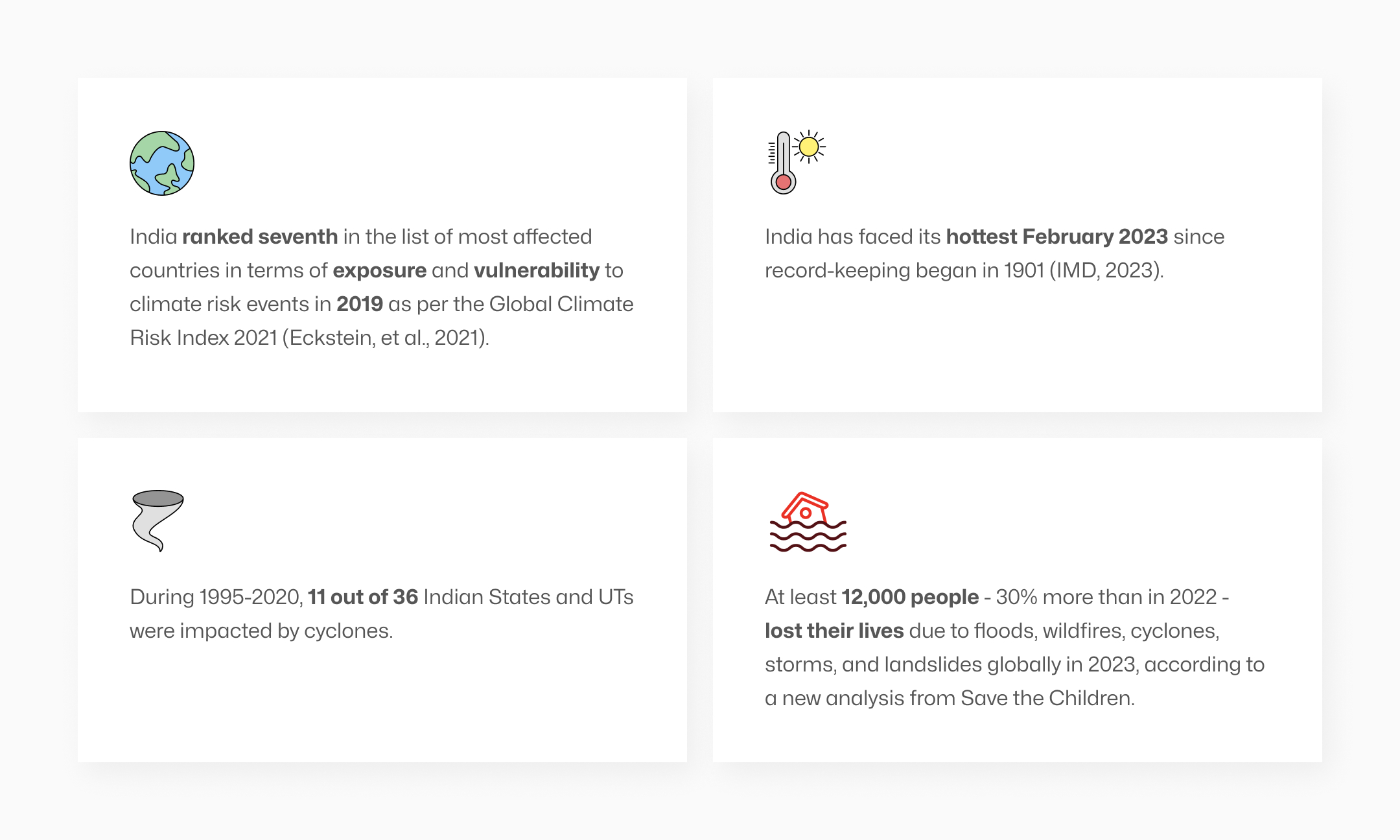

Art lovers worldwide gasped in horror as news of climate activists hurling soup at the famous painting Mona Lisa splashed across social media. While it may be a flamboyant way to derive attention, no one can deny the critical issue at the heart of such dramatic display i.e. climate change. February 2023 marked the hottest on record for India since the commencement of record-keeping in 1901, as reported by the IMD. Following this, in March, significant regions of the country witnessed unexpected hailstorms and torrents of unseasonal rain, sparking concerns about potential widespread damage to standing crops. The culprit - climate change.

As we navigate the increasingly complex world burdened by natural calamities and geopolitical uncertainties, we must evolve ourselves to meet the challenges and Parametric Insurance emerges as the innovative solution, offering a faster and more efficient way to manage risks.

Parametric Insurance is a sharp departure from the conventional indemnity-based policies which Indian policyholders are more familiar with. Parametric Insurance insures the policyholders against the occurrence of a specific event by paying a predetermined amount depending on the magnitude of the event. These parameters, often tied to meteorological or seismic data, provide a more efficient and rapid response to policyholders in the event of a covered occurrence.

The allure of Parametric Insurance lies in its ability to bridge the gap between insurance and risk management, offering a streamlined approach to handling uncertainties. Let's delve into why this emerging insurance model deserves serious consideration.

The Unpredictable Nature Of Risks

The past decade has witnessed a surge in natural disasters and unforeseen events, from hurricanes and wildfires to global pandemics.

Traditional insurance models often struggle to keep pace with these rapidly changing risk landscapes. Parametric Insurance, on the other hand, utilises real-time data to trigger payouts, ensuring a swift response to policyholders in the aftermath of a covered event.

Parametric Insurance In Action

A great example to see Parametric Insurance in action:

To build financial resilience, Nagaland became the 1st Indian state to opt for Parametric Insurance for protection against excessive rainfall events that can lead to severe flooding.

The effectiveness of Parametric Insurance is exemplified in various sectors. Agriculture, for instance, has embraced Parametric Insurance to protect farmers against the caprices of weather. By setting specific weather parameters, such as rainfall levels, payouts can be triggered automatically, offering farmers financial support during droughts or excessive rainfall.

In the travel industry, Parametric Insurance has found its footing by providing compensation based on predefined conditions, such as flight delays or cancellations. This not only expedites the claims process but also enhances customer satisfaction by offering a transparent and predictable compensation mechanism.

Parametric Insurance and Economic Resilience

In 2022, India faced a $4.2 billion economic loss due to floods and other climatic disasters, as reported by the World Meteorological Organization (WMO). Beyond its efficiency in claims processing, Parametric Insurance plays a crucial role in enhancing economic resilience. Rapid payouts enable businesses and individuals to recover swiftly from losses, reducing the overall economic impact of a disaster. This is particularly relevant in regions prone to frequent natural disasters, where a swift injection of funds can expedite recovery efforts and prevent a prolonged economic downturn.

It is indeed time to take Parametric Insurance seriously. In the face of escalating natural disasters, India needs to evolve from the traditional indemnity-based insurance models towards innovative and compelling insurance solutions.