Bangladesh's insurance sector boasts immense potential, yet a significant portion of the population remains unserved. Bangladesh is on the verge of unlocking the Bancassurance model of the country. Traditional Bancassurance partnerships, while promising, are often hindered by cumbersome processes and manual operations. An approach to penetrate this market with the help and support of InsurTech, and innovative solutions, could bridge this gap and unlock a new era of efficiency and accessibility in the Bangladesh insurance market.

An InsurTech can help with the following:

An InsurTech can help with the following:

Streamlining the Customer Journey:

Digital Onboarding: Paper-based applications create a significant barrier to entry. InsurTech solutions like Optical Character Recognition (OCR) can pre-fill forms by extracting data from uploaded documents during policy purchases. This significantly reduces turnaround time and enhances customer experience.

Seamless Policy Issuance: Traditional methods often involve lengthy processing times. InsurTech platforms can automate policy issuance, mirroring the success stories across the globe.

Data-Driven Personalisation: Legacy systems lack the ability to leverage customer data effectively. InsurTech facilitates in-depth data analysis, enabling insurers and banks to

Personalise insurance offerings based on individual needs and risk profiles.

Recommend relevant products for cross-selling, increasing customer lifetime value.

Revolutionising Claims Management:

Simplified Claim Reporting: InsurTech platforms allow for online claim intimation, eliminating the need for physical visits and paperwork.

AI-powered Solutions: Advanced algorithms can analyse claim data to identify potential fraudulent activities, safeguarding insurers from financial losses.

Faster Claim Settlement: Streamlined digital workflows expedite claim processing, ensuring quicker claim payouts to policyholders, and improving customer satisfaction.

Addressing Regulatory Requirements:

Compliance Automation: InsurTech solutions can be designed to adhere to evolving regulations, incorporating features for

Automatic data capture and reporting to regulatory bodies.

Adhere to Regulatory compliance checks during policy issuance and claim processing.

Transparency and Data Security: InsurTech platforms prioritise data security to maintain the trust and transparency of banks and insurers.

Secure data storage practices that comply with data privacy regulations.

User-friendly interfaces that provide clear information about data usage and privacy policies.

InsurTechs Set to Play a Crucial Role in Bangladesh Bancassurance

InsurTechs are set to play a pivotal role in Bangladesh's bancassurance landscape, offering a synergy that propels the insurance sector forward. In this dynamic arena, collaboration emerges as the linchpin for progress, with InsurTechs acting as indispensable tech allies to traditional insurance carriers and banks. Their emergence heralds a cost-effective avenue for digital transformation, leveraging technology to augment existing business frameworks.

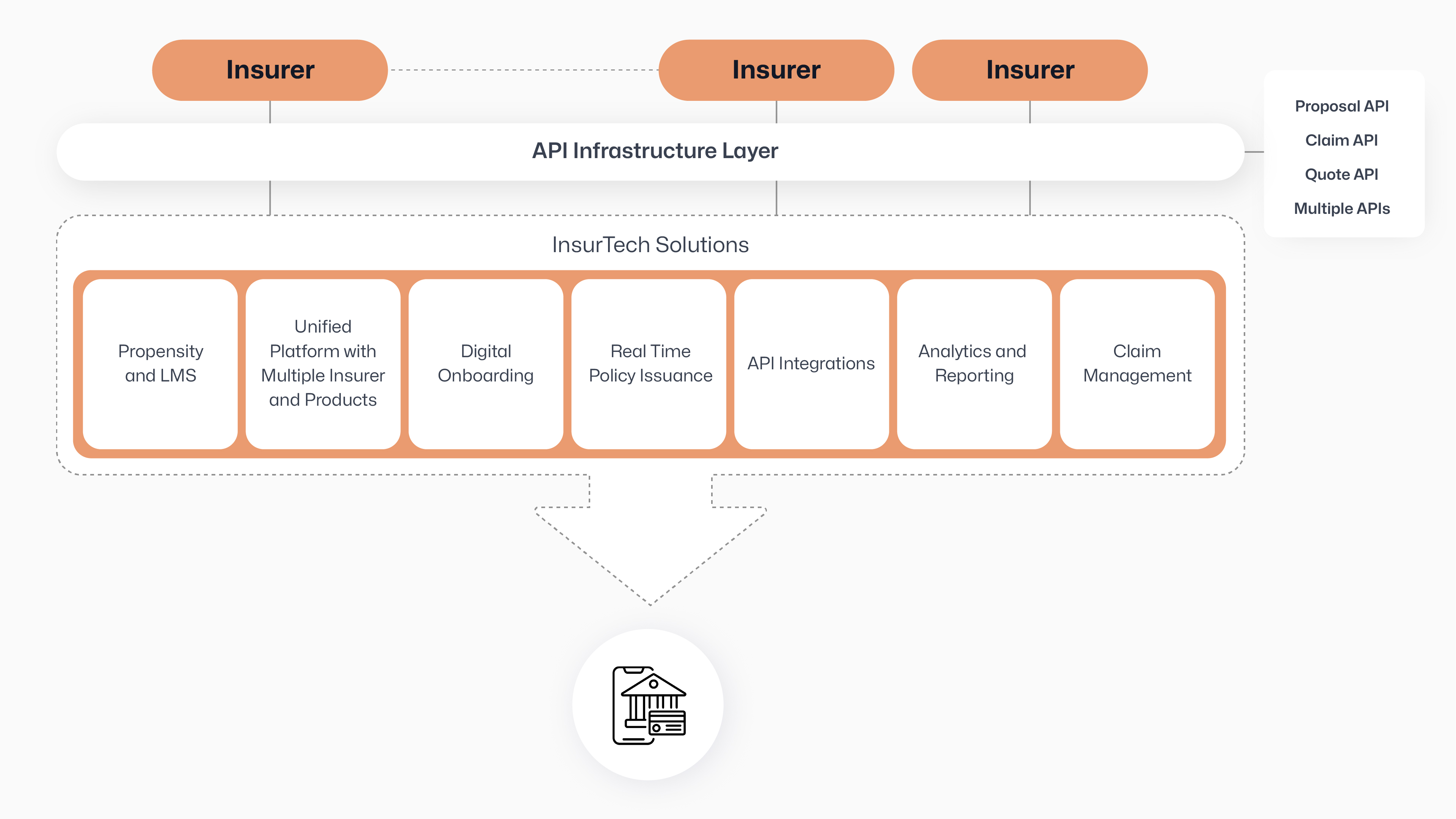

Offering a suite of plug-and-play technology solutions, InsurTechs seamlessly integrate multiple modules into current systems, revolutionizing various facets of the insurance value chain.

Through an API infrastructure layer, they serve as gatekeepers, providing a streamlined connection point for insurers and distributors. This standardized approach accelerates product launches and simplifies the integration of new insurance partners into the bancassurance network for banks. Meanwhile, a microservices architecture facilitates independent development and scaling of functionalities, ensuring agility and security in information exchange.

Key Milestones in the Insurance Digital Transformation Journey Include:

Implementation of Digital Sales strategies, streamlining the enrolment of Insurance Plans.

Establishment of a comprehensive Digital Platform, encompassing Apps and Customised Web-page Solutions.

Integration of Digital Risk Assessment and Underwriting processes.

Implementation & Facilitation of Digital Customer Servicing and Claims Management.

InsurTech Advantage for Banks and Insurers:

InsurTechs offer a compelling advantage for both banks and insurers in Bangladesh, presenting a cost-effective and scalable alternative to proprietary solutions. By avoiding the hefty investment required to build in-house IT teams and develop proprietary software, insurers can focus resources on innovation and expanding their core business.

As Bangladesh stands on the brink of significant transformation, particularly in the insurance sector, there lies a tremendous opportunity to enhance accessibility and benefits for both consumers and businesses. However, this transition requires concerted efforts from policymakers, regulators, and industry stakeholders to facilitate technological advancements and foster ecosystem growth. Through strategic collaboration and a forward-thinking approach, Bangladesh can unlock the full potential of InsurTech as an extended tech arm, driving digital transformation and growth in the insurance landscape.

Zopper, a prominent Indian InsurTech, stands as a testament to the transformative power of collaboration. Through its Bancassurance platform, it has empowered numerous large banks and insurance companies, including one of India's largest banks, catering to over 153 million customers.