Studies have shown that vehicles equipped with telematics devices experience up to a 40% reduction in accidents compared to those without.

Technology is causing a change in the insurance industry. Motor insurance is changing due to telematics, an innovative technology that combines informatics and telecommunications and allows for a more data-driven approach to risk assessment and pricing.

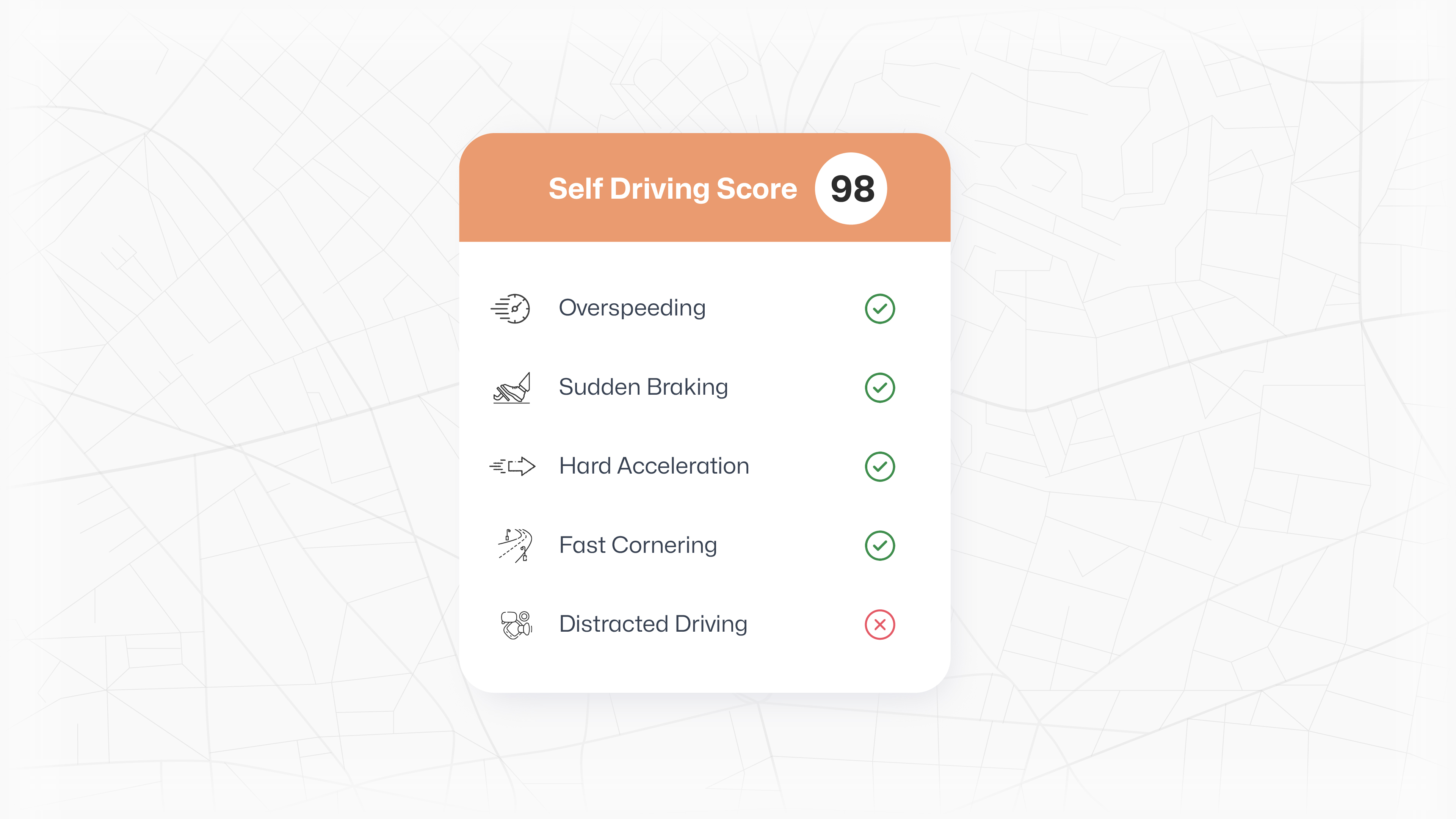

Telematics insurance, also known as Usage-Based Insurance (UBI) or pay-how-you-drive insurance utilises a telematics device installed in your vehicle. This device collects data on various driving parameters, including:

Distance traveled

Speed patterns

Braking and acceleration habits

Time of day driven (daytime, nighttime, weekends)

Road type (highway, city streets)

By collecting and analysing this data, insurers create a more accurate picture of a driver's driving pattern and risk profile. This allows them to offer personalised premiums that reflect your driving habits, rewarding safe drivers with lower rates.

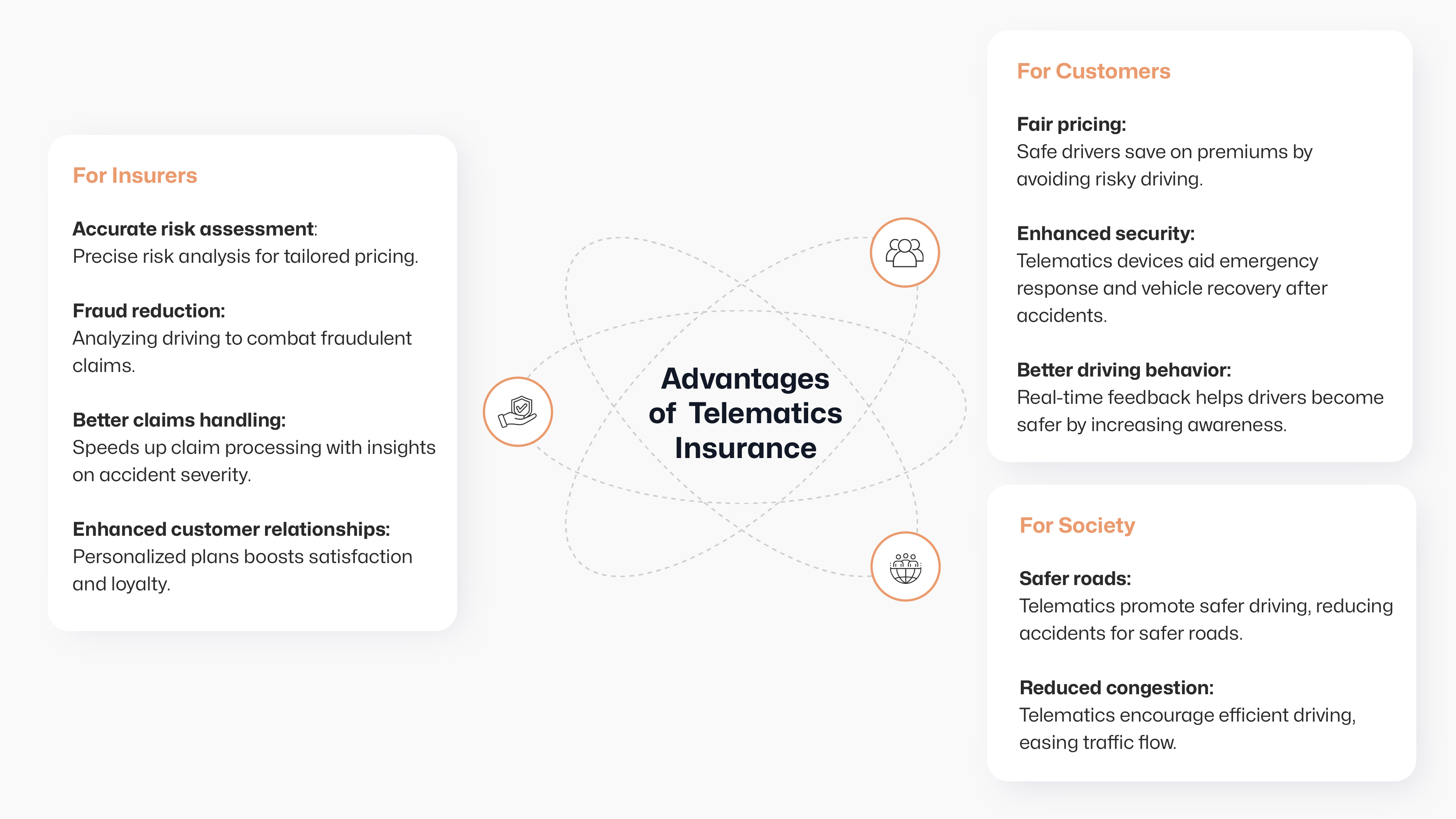

Advantages of Telematics Insurance

Advantages of Telematics Insurance

Customers enjoy several benefits from telematics. Safe driving habits are rewarded with lower premiums, promoting safer roads. Telematics devices also enhance security by acting as trackers during accidents, facilitating emergency response and recovery of the stolen vehicle. It also provides real-time feedback on driving habits which helps drivers modify their behavior and adopt safer habits.

For insurers, it enables better customer segmentation and pricing strategies through detailed driving data for accurate risk assessment. Additionally, it helps reduce fraud by analysing driving patterns during accidents and detecting false claims. It also facilitates faster claims through insights into accident severity. Personalised insurance plans and feedback strengthen customer relationships and lead to higher satisfaction and retention.

Beyond individual benefits, telematics creates a safer and smoother society. By incentivising safe driving habits, ultimately reduces accidents. Moreover, telematics promotes efficient driving patterns, contributing to smoother traffic flow and improved overall road safety and efficiency.

In essence, telematics is a powerful tool that benefits individuals, insurers, and society as a whole, by making roads safer and traffic smoother.

In essence, telematics is a powerful tool that benefits individuals, insurers, and society as a whole, by making roads safer and traffic smoother.