The microfinance industry in India is helping to bridge the financial inclusion gap, bringing much-needed financial services to the low-income and underserved segments. What traditional financial institutions fail at, digital microfinance infrastructure achieves by providing small loans, insurance, savings and other financial products that promote entrepreneurship and inclusion. The market comprises a mix of microfinance institutions (MFIs), NBFCs, and self-help groups, which are supported by government initiatives and a healthy regulatory environment.

Given its critical role in driving economic empowerment and poverty alleviation, the evolution of microfinance in emerging markets like India will be crucial to achieving its ambition of becoming a $5 trillion economy by 2025. And despite this industry's challenges, not the least of which is high interest rates, the microfinance market is expected to expand at a CAGR of 12.58% from 2024 to 2034.

Advances in technology and the transition to a digital ecosystem are powering the segment to provide on-demand products and services while making the entire experience frictionless. Plus, digital innovation in microfinance makes it cost-effective for MFIs to make their services accessible even to remote areas. This transformation also underscores the challenges of digitising microfinance operations, especially in terms of infrastructure and customer onboarding.

Read More: Insurance Ombudsman: Everything you need to know

The Role of Technology in Driving Digital Innovation in the Microfinance Sector in India

Technology is the cornerstone of making financial services more accessible for India's underserved and unserved markets. Tech innovations are expanding opportunities for MFIs while creating new engagement channels. Technological advancements are also proving invaluable in maximising operational efficiency and productivity. Forging meaningful partnerships between MFIs and tech startups can arm microfinance institutions with future-proof technology to drive financial inclusion and business growth.

Here’s a look at how MFIs in India can make the most of existing and emerging opportunities and be a part of the nation’s growth story by adopting the latest tech solutions.

Efficiency Gains

AI-powered automation is not only leading to efficiency and productivity gains, but it is also reducing the dependence on manual intervention and the risk of manual error. From risk assessment to loan processing, automation is streamlining operations, reducing costs for MFIs and allowing them to service more customers without expanding their teams. In addition, data analytics is empowering MFIs to identify inefficiencies and bottlenecks. This, in turn, allows them to optimise resource utilisation to bring in greater efficiency and cost savings - another facet of digital innovation in microfinance.

Enhanced Customer Experiences

Digital microfinance infrastructure enables MFIs in India to reach out to existing and potential customers through the channels of their choice, including social media, messaging apps, mobile apps, and more. Seamless interactions, real-time support via chatbots and intuitive tools to manage one's finances make customers feel more in control of their financial goals. This way, positive experiences begin even before the customer enters the sales funnel.

What is even better is that technology tools enable microfinance providers to ensure satisfying experiences throughout the customer’s lifecycle. This starts right from onboarding, where tech advancements allow MFIs to offer a paperless and agile application process, assess creditworthiness in minutes and even complete KYC through e-document verification - helping MFIs overcome the challenges of digitising microfinance operations.

Personalisation

AI-powered big data analytics allows MFIs to use data from diverse sources to personalise customer experiences, offer recommendations, and proactively address individual needs. This is a core pillar of digital innovation in microfinance. Data analytics also powers cross-selling and upselling while helping MFIs discover new opportunities and markets. Plus, personalised notifications and alerts keep customers engaged.

AI-driven analytics tools offered by leading insurtech providers in India provide MFIs with insights into customer behaviour at a granular level. This supports the development of more effective digital microfinance infrastructure, with insights into transaction patterns, financial preferences and needs. This also allows you to tailor products and services to their needs and project your brand as one that understands and cares about the customer.

Predictive Analytics

This is one aspect of data analytics that can help microfinance institutions proactively address market needs and build a competitive edge. By analysing historical data, they can gain valuable insights into future trends. The most significant advantage is the ability of AI/ML-powered tools to extract structured and unstructured data from diverse sources to drive informed decision-making - an example of how partnerships between MFIs and tech startups are reshaping financial services.

For instance, for an agriculture-driven economy like India, predicting rainfall levels for the next monsoon can help microfinance providers tailor loans for farmers and create awareness about their products well in advance.

Underwriting and Disbursing Loans

Creditworthiness checks have become quick and easy with the availability of tech tools. MFIs can collaborate with insurtech providers to integrate scoring models to power real-time loan decisions. These digital tools reduce the cost of loan underwriting, addressing key challenges of digitising microfinance operations. When costs to the MFI are minimised, they can pass the savings on to customers.

In addition, cloud computing in MFIs has enabled host-to-host banking for real-time loan disbursal and cashless transfers via IMPS/NEFT/RTGS and Aadhar-enabled systems.

Real-Time Digital Payments

India’s Unified Payment Interface (UPI) is easing service provision for MFIs, driven by the rapid penetration of smartphones nationwide. This is another driver of digital microfinance infrastructure. The penetration rate of smartphones was recorded at 71% in 2023, which is expected to reach 96% by 2040. MFIs are integrating UPI to offer secure and swift transactions, a trend that aligns with the government’s push for a digital, cashless economy. It also caters to the preferences of India's young, tech-savvy population and allows MFIs to ensure financial accessibility.

This trend also reflects the evolution of microfinance in emerging markets, where smartphone-led digital access is transforming how credit and repayment are handled. Digital payments are witnessing a massive surge in the country, with transaction volumes registering 42% year-on-year growth in FY2023-24. Transaction volumes via digital means are projected to soar from 159 billion in FY2023-24 to a whopping 481 billion by FY2028-29, with the transaction value growing from ₹265 trillion to ₹593 trillion during the same period.

Buy Now Pay Later

Buy Now Pay Later (BNPL) is one of the most essential services emerging from the digital payment revolution. BNPL not only reflects how digital innovation in microfinance is transforming consumer engagement and credit accessibility but also redefines purchase behaviours and gives the average Indian significantly greater financial flexibility. With the ability to process credit requests almost instantaneously without compromising creditworthiness and risk evaluations, MFIs are enhancing customers’ buying power. On the other hand, flexible, digital repayment options, including via UPI, make loan repayment affordable and convenient for borrowers.

Fraud Detection and Prevention

The finance sector is a key target for cybercriminals. Cybersecurity in digital microfinance is a growing concern as digitalisation and an increasingly interconnected ecosystem have expanded the vulnerable attack surface manifold. This has made using advanced technologies to strengthen cybersecurity an imperative for the sector and MFIs are no different. AI/ML analyse vast datasets in real-time to identify customer behaviours and patterns.

Technology tools offered by leading insurtech companies in India empower MFIs to tackle fraud proactively, showcasing the importance of cybersecurity in digital microfinance. Multifactor authentication, the use of biometrics and the protection of customers’ sensitive data are all powered by technology.

The Rise of RegTech

The regulatory landscape is undergoing rapid evolution as financial watchdogs, including the RBI, work to protect consumer interests across digital financial channels. RegTech is aiding digital innovation in microfinance by automating repetitive tasks, enhancing compliance, and ensuring data security. These capabilities are often enhanced through partnerships between MFIs and tech startups in the insurtech domain. It is positioning the microfinance industry for sustainable success.

The Future of Microfinance in India

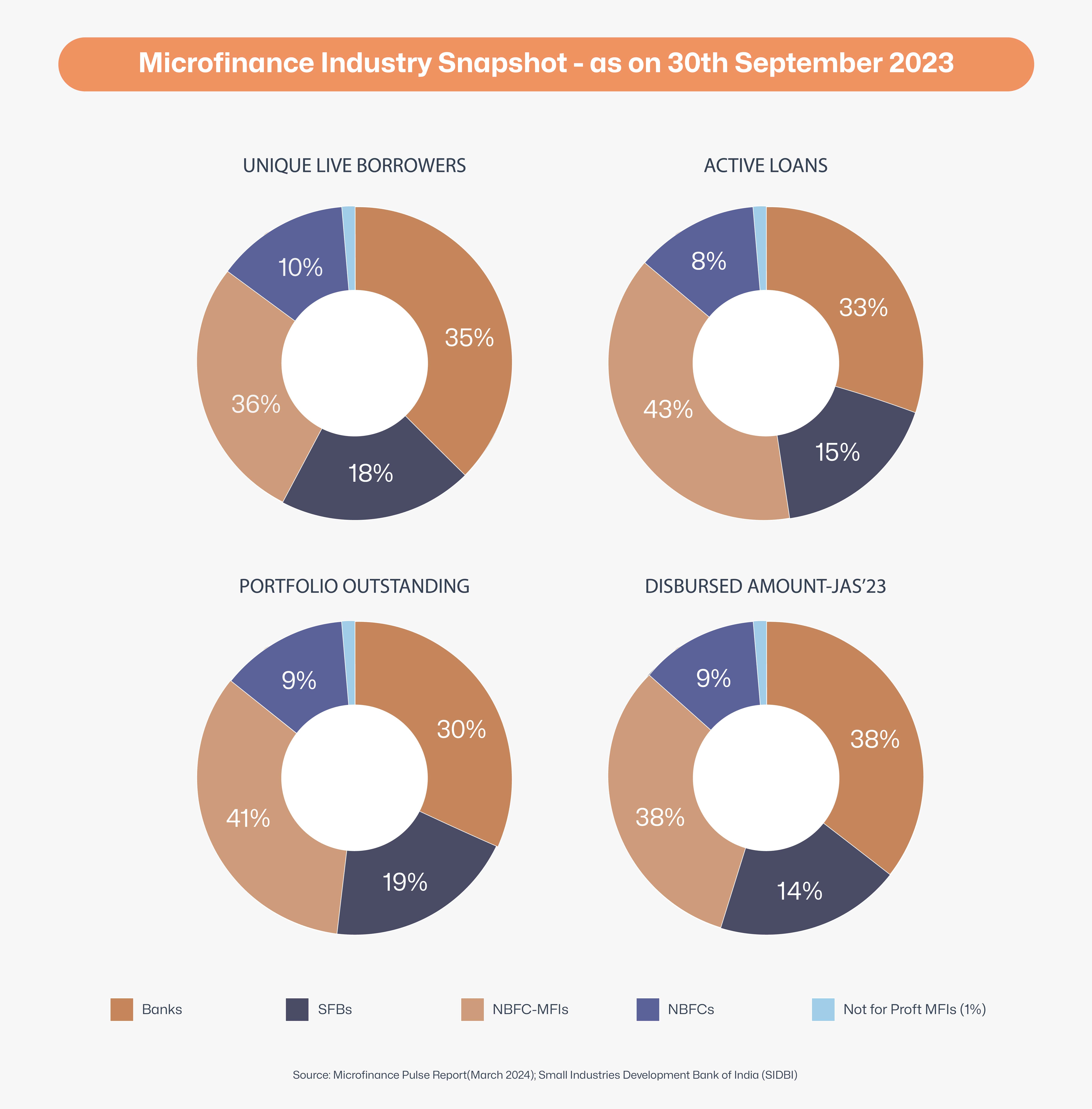

Loan portfolios of microfinance lenders rose 24.5%, year-on-year, in FY2023-24, with the outstanding Gross Loan Portfolio growing 22.03% to reach ₹3,48,339 crores by the end of March 2023. Compare this to the sluggish growth of traditional banks, which stood at 4.5% for FY2023. Multiple factors are expected to continue to drive the growth of microfinance in India, including:

Strong growth in demand for credit

Regulatory support via government initiatives and favourable regulatory frameworks

The global focus on financial inclusion

Advances in technology support cost-effective service delivery to the remotest regions

The evolution of microfinance in emerging markets like India hinges on technology adoption. MFIs that embrace cloud computing, AI, and analytics through partnerships between MFIs and tech startups will be best positioned to scale efficiently.

Microfinance institutions that forge meaningful partnerships with insurtech solution providers will ideally position themselves to capture emerging opportunities. For instance, Zopper powers banks, NBFCs and MFIs with customisable, flexible and scalable plug-and-play tools to stay ahead of the curve. These tools support robust digital microfinance infrastructure, allowing financial institutions to cater to the evolving needs of today's consumers, despite the challenges of digitising microfinance operations.

Also Read: Understanding OPD Benefits in Health Insurance In India

Frequently Asked Questions

What is the digital transformation of microfinance?

The digital transformation of microfinance refers to the integration of technology into every facet of microfinance operations to improve reach, efficiency, and customer experience. With a strong digital microfinance infrastructure, institutions can now offer paperless onboarding, mobile-based financial services, and real-time disbursements. This shift is crucial for expanding financial inclusion in underserved regions. Insurtech companies have also enabled digital innovation in microfinance, helping MFIs lower operational costs and enhance customer engagement. As a result, digital transformation is driving scale, transparency, and accessibility across the sector, ensuring financial services reach even the most remote and vulnerable communities in a sustainable, tech-led manner.

How is artificial intelligence (AI) being used in microfinance today?

Artificial intelligence is driving a new era of digital innovation in microfinance, helping institutions automate decision-making and personalise customer experiences. AI algorithms process massive datasets to assess creditworthiness, predict customer behaviour, and identify real-time fraud. Through predictive analytics and AI-powered chatbots, MFIs can improve customer support and streamline loan approvals. These tools enable microfinance institutions to deliver tailored financial products and services, improving customer retention. Ultimately, AI helps MFIs operate more efficiently and serve a broader customer base with fewer resources - key benefits for institutions looking to scale in competitive, low-margin financial inclusion environments.

What role do APIs play in digital microfinance systems?

APIs (Application Programming Interfaces) are vital components of digital microfinance infrastructure, enabling seamless integration between systems and partners. They help MFIs connect with credit bureaus, KYC platforms, payment gateways, and insurtech tools in real time. APIs allow for faster service delivery, automation of back-end processes, and better user experiences. By supporting interoperability, APIs empower MFIs to create agile platforms and expand services rapidly. Through partnerships between MFIs and tech startups, API-driven ecosystems promote innovation and scalability, making it easier to roll out new financial products or features. In essence, APIs are the digital rails upon which modern microfinance rides.

What are the main challenges of digitising microfinance operations?

The challenges of digitising microfinance operations include limited digital literacy among borrowers, inadequate infrastructure in rural areas, and cybersecurity risks. Many MFIs also struggle with legacy systems that don’t support seamless integration with new technologies. High upfront investment in tech, change management, and regulatory compliance further complicate digital transitions. In emerging markets, connectivity issues can hamper real-time operations. Moreover, building trust in digital services remains a hurdle. Overcoming these challenges requires strong leadership, tailored training, and robust digital microfinance infrastructure that’s secure, scalable, and user-friendly for both customers and field agents operating at the grassroots level.

How does cloud computing benefit microfinance institutions?

The role of cloud computing in MFIs is critical to reducing operational costs, enhancing data security, and improving scalability. With cloud-based systems, microfinance institutions can store and access data securely from any location, enabling real-time loan processing and customer service, even in remote areas. Cloud platforms also support faster deployment of updates, data analytics, and regulatory reporting. For smaller MFIs with limited IT resources, cloud computing offers a cost-effective way to modernise infrastructure. As part of the broader digital transformation of microfinance, cloud-based tools empower institutions to innovate faster, collaborate better, and serve customers more efficiently.

What is the future of the microfinance sector?

The future of microfinance lies in the seamless evolution of microfinance in emerging markets through digitisation, AI, and inclusive partnerships. Increasing smartphone penetration, supportive regulations, and rising demand for credit will fuel growth. MFIs that invest in robust digital microfinance infrastructure and form strategic partnerships between MFIs and tech startups will lead the way. With tools like UPI, eKYC, and AI-driven analytics, microfinance institutions can improve reach, efficiency, and customer trust. As technology and finance converge, the sector is poised to become more agile, inclusive, and data-driven, paving the way for a more financially empowered and resilient population.

Bibliography (Last accessed on September 16, 2024)

https://evolvebi.com/report/india-microfinance-market-analysis/

https://finezza.in/blog/ways-tech-in-finance-is-transforming-microfinance-institutions/

https://www.statista.com/statistics/1229799/india-smartphone-penetration-rate/

https://www.zopper.com/blog/ai-in-insurance-how-is-ai-transforming-insurtech