The Asia-Pacific region is expected to dominate the bancassurance market between 2024 and 2032. India is poised to be among the leaders driving the expansion of the insurance sector in the region. Bank intermediation has significantly increased insurance adoption in the Indian market. Sighting the opportunities, banks are increasingly adopting open technology architecture to support insurers penetrating the country's underserved and unserved markets. Here’s a deep dive into the factors driving the success of bancassurance and ways you can generate business growth in the Indian insurance market.

4 Factors Driving Bancassurance Success in India

4 Factors Driving Bancassurance Success in India

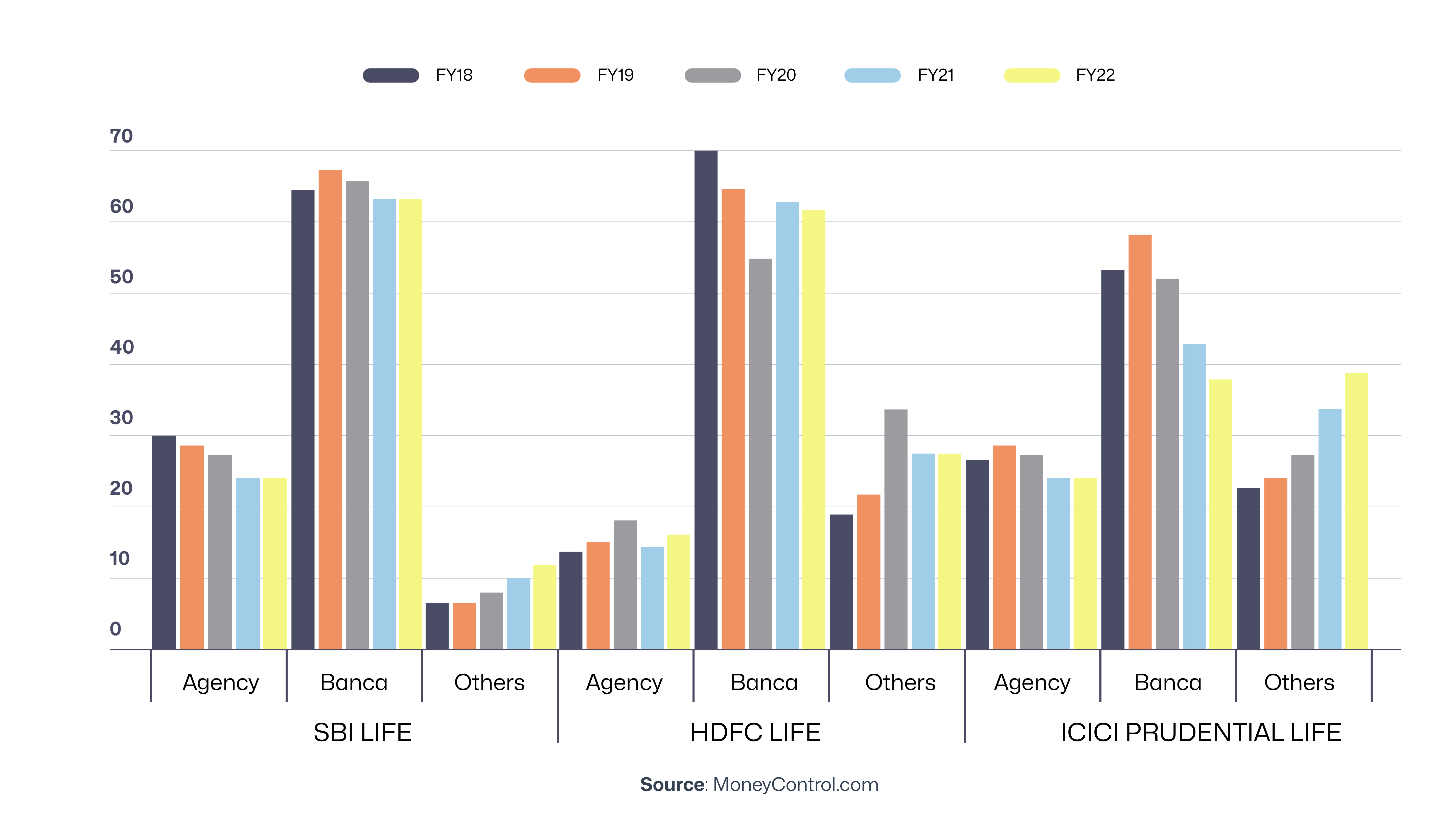

The omnipresent banking network in India brings over 50% of premiums for the insurance sector. In the private sector, bancassurance accounts for 55% of premiums in the individual business insurance segment. Bancassurance contributed the highest share among distribution channels in annualised premiums in India in the five years from FY2018 to FY2022.

Share of Bancassurance in Annualised Premiums:

Factors driving the growth are:

Factors driving the growth are:

Increased Customer Awareness

The rising ageing population in India, which is expected to reach 20% of the total population by 2050, has increased the need for health and geriatric care insurance. The pandemic emphasised the importance of life and health insurance among Millennials and Gen Z, especially those with dependents. The young cohort is keen on entrepreneurship, which has supported the growth of the business insurance vertical. Since the banking sector has a greater reach and has earned more trust, customers perceive the channel as more reliable to buy insurance.

Government Support

The Indian government has launched several schemes to boost insurance inclusion levels for various segments. The crop insurance scheme, Pradhan Mantri Fasal Bima Yojana (PMFBY), and the rural health insurance scheme, Pradhan Mantri Jan Arogya Yojana (PMJAY) for secondary and tertiary hospitalisation, lead the way. Over 56.8 crore applications were processed to enrol farmers between 2016 and 2024. More than 23.2 crore claims have been disbursed during the period under PMJAY.

Regulatory Focus

IRDAI emphasises leveraging the vast branch banking network to make insurance products reach the “last mile” across India. IRDAI views bancassurance as instrumental in achieving the ‘Insurance for All by 2047’ goal. The organisation is taking the necessary measures to help bancassurance flourish in India:

Encouraging Bank and Insurance Provider Collaboration

IRDAI plans to mandate at least one insurance partnership for all banks to regulate the sales of insurance products through banking channels. The authority may cap the bank's commissions relative to the insurance premiums obtained. Simultaneously, measures are being discussed to prevent mis-selling and provide inadequate advice.

Supporting the Banking Staff

The regulator also plans to issue guidelines around the minimum training requirements for a bank’s staff to function as insurance agents. This is to help them suggest the best-fit insurance products to customers while paving the way for fair incentives for the bank to avoid conflicts of interest. IRDAI is expected to issue measures to delink the performance of banking employees from their insurance sales targets to eliminate stress.

Policies for Bancassurance Success

IRDAI has replaced the cap on commission expenses with a cap on expenses of management (EoM) for insurers. The cap currently sits at 30% of the gross written premium for general insurance and 35% for health insurance. This provides insurance companies in India greater freedom to manage their expenses. Greater flexibility allows insurers to use funds to develop innovative, customer-centric products and distribution channels. This offers a runway for greater technology adoption in the sector.

Charting the Route to Success

In October 2023, IRDAI constituted a task force to assess the bancassurance model. The task force will identify global best practices that can be integrated into the Indian market and areas that need greater regulatory oversight.

Digitisation Powered by InsurTech Companies in India

Did you know that 60% to 80% of insurance agents exit the system within four years of hiring? Relying on manual agents is risky as customer relationships get strained when the only link between them and the insurer breaks. Technology adoption can help automate customer interactions (with RPA) to eliminate the reliance on manual channels for customer acquisition and retention. The seamless integration of banking and insurance through digital channels can further facilitate the growth of bancassurance in India. InsurTech companies in India, such as Zopper, have the experience and expertise to do just that. They support insurers and banks in creating collaborative digital channels to boost sales and improve customer satisfaction.

InsurTech leverages data from the banking and insurance sectors to offer deep insights into customer behaviour. Insurers can use these insights to create tailored products to meet the needs of diverse target groups, while banks can discover cross-selling and upselling opportunities. Advanced technologies, such as predictive analysis, machine learning (ML), and artificial intelligence (AI), help improve risk management and automate underwriting and claims settlement. InsurTech creates a win-win for both participants and is expected to fuel bancassurance growth in India.

Maximise Gains from Bancassurance Opportunities

Customers choose an insurance product via a banking channel based on several factors. These include convenience, premium levels, coverage, trust in banks, and the effectiveness of marketing channels in the banking sector. Bancassurance partners must strategically leverage InsurTech to maximise gains, with the convergence of the best of both industries. Here are the steps to follow:

Assess the existing banking system to determine whether it fits the purpose by identifying the capabilities that align with the purpose and those that are needed but don’t align.

Define an operational playbook to develop a cooperative process model with a collaborative governance framework.

Reengineer processes to simplify customer journeys with unified funnels and seamless digital journeys.

Develop hyper-personalised pre-quote and final offers and bundle credit and wealth management solutions with insurance products.

Incorporate data analytics to quantify propensity, identify cross-selling opportunities, calculate customer lifetime value (CLTV), and predict customer churn.

Upskill banking and insurance staff to optimally leverage the digital insurance platforms offered by InsurTech and adopt agile working styles.

Commit to regular reviews and process improvements to stay ahead of the competition.

Leverage InsurTech

IMARC expects the market size of bancassurance in India to expand at a CAGR of 6.2% from 2024 to 2032 to reach $172.4 billion. This presents a massive opportunity for banks and insurance providers. Interest from foreign investors also highlights the positive outlook. For instance, Switzerland-based Zurich Insurance Group plans to acquire a stake in Kotak General Insurance to boost cross-market industry growth in India. IBEF believes robotic process automation (RPA) and AI will improve data processing capabilities to determine newer revenue streams.

Insurers must innovate and scale to exploit the synergies between banking and insurance. You can leverage InsurTech to accelerate the transition. Strategically partnering with insurance technology providers can be a game-changer for banks and insurers. In addition, they can help you create agile business models that change with evolving customer demands. InsurTech also improves your regulatory posture by automating compliance checks and reporting. Intelligent process upgrades can help you stay up-to-date with the evolving regulatory environment. Additionally, InsurTech can increase transparency across operations and help prevent penalties with automated regulatory reporting. InsurTech companies in India are equipped to help bancassurance participants navigate the rapidly changing industry.

Bibliography: (Last accessed on Sep 6, 2024)