Risk management and prediction accuracy are the foundational elements of insurance. The ability of artificial intelligence (AI) systems to process massive datasets, offer predictive analytics, and identify patterns and anomalies perfectly meets the industry’s needs. It comes as no surprise that the global AI in insurance market is forecasted to reach a value of $39.55 by 2034, growing at a remarkable CAGR of 33.06% from 2025. The explosive penetration of always-connected IoT devices further drives innovation. This fuels greater integration of AI in insurance, powered by data and machine-learning business models. A key factor fuelling rapid adoption of the technology is the breadth and versatility of AI use cases in the insurance sector. For instance, the role of generative AI in insurance has expanded from automated customer assistance to offering data-backed policy development suggestions.

AI in Insurance is a Transformative Force

AI instils agility and flexibility across insurance processes, empowering insurers to harness better returns for their investments in the technology. The technology has created several opportunities to offer modern insurance products for the entertainment, telecom, e-commerce, mobility, and other non-traditional sectors. Here are a few examples of how AI benefits the insurance industry.

Expedites Underwriting

Manual underwriting is time-consuming and prone to error. Traditional methods of creditworthiness assessment, background health checks, etc., fail to meet the need for immediacy in the current markets.

Employing AI in insurance underwriting can improve accuracy by up to 10% and convert weeks-long processes into minutes. The expedited issuance time enhances customer experiences, and the reduced administrative workload frees employees to add value for the insurer and its customers.

Enhances Claims Processing

Claims processing is one of the most crucial activities in the insurance industry and most prone to fraud. Inaccuracies here cost insurers time, money, and reputation.

AI-driven claims processing leverages data and analytics to identify inconsistencies, discover fraud patterns, and reduce errors. AI-enabled predictive models facilitate insurance claims processing, saving time and money and enhancing ROI for insurance providers.

Allows Personalisation at Scale

Traditional inflexible insurance products do not address the needs of today’s insurance market. Customers demand products that evolve with their needs and can be tailored to their specific requirements.

An essential role of AI in insurance is offering personalised experiences. These include identifying specific user needs, tailoring premiums, and customising coverage terms to the buyer’s needs.

Redefines Customer Support

While IVR-based robotic assistance has been in place for a while, rule-based lengthy query resolutions often hurt customer experiences. Moreover, they disseminate the message of machine-driven support, which makes customers feel distant from the insurer.

Anytime/anywhere customer assistance is among the most powerful and widely employed AI use cases. The inclusion of Gen AI in insurance brings non-sympathetic mechanical experience to life, enabling insurtech to offer more human-like support digitally.

Enables Live Monitoring

Knowing exactly what was going on in the background has been a long-standing challenge for the insurance industry. This translates into ineffective risk assessment and inaccuracies in claims processing.

Synergies of AI and IoT devices have been a game-changer for insurtech. For instance, vehicle insurers can leverage real-time driving analytics to determine everything from risk to claims accuracy.

Increase Operational Efficiency

The insurance industry has tons of data at its disposal. However, manual data entry, documentation, compliance verification, etc., are time-intensive and prone to human error. Inconsistencies in data can result in delays in claims processing or flawed data analytics.

AI-driven automation of repetitive tasks and data management streamlines operations. This directly saves employees time by taking over administrative tasks. It also saves the time that could have been lost to navigating data inconsistencies and fixing human errors. Insurance agents can utilise the additional available time for more value-added tasks, driving business growth.

.png)

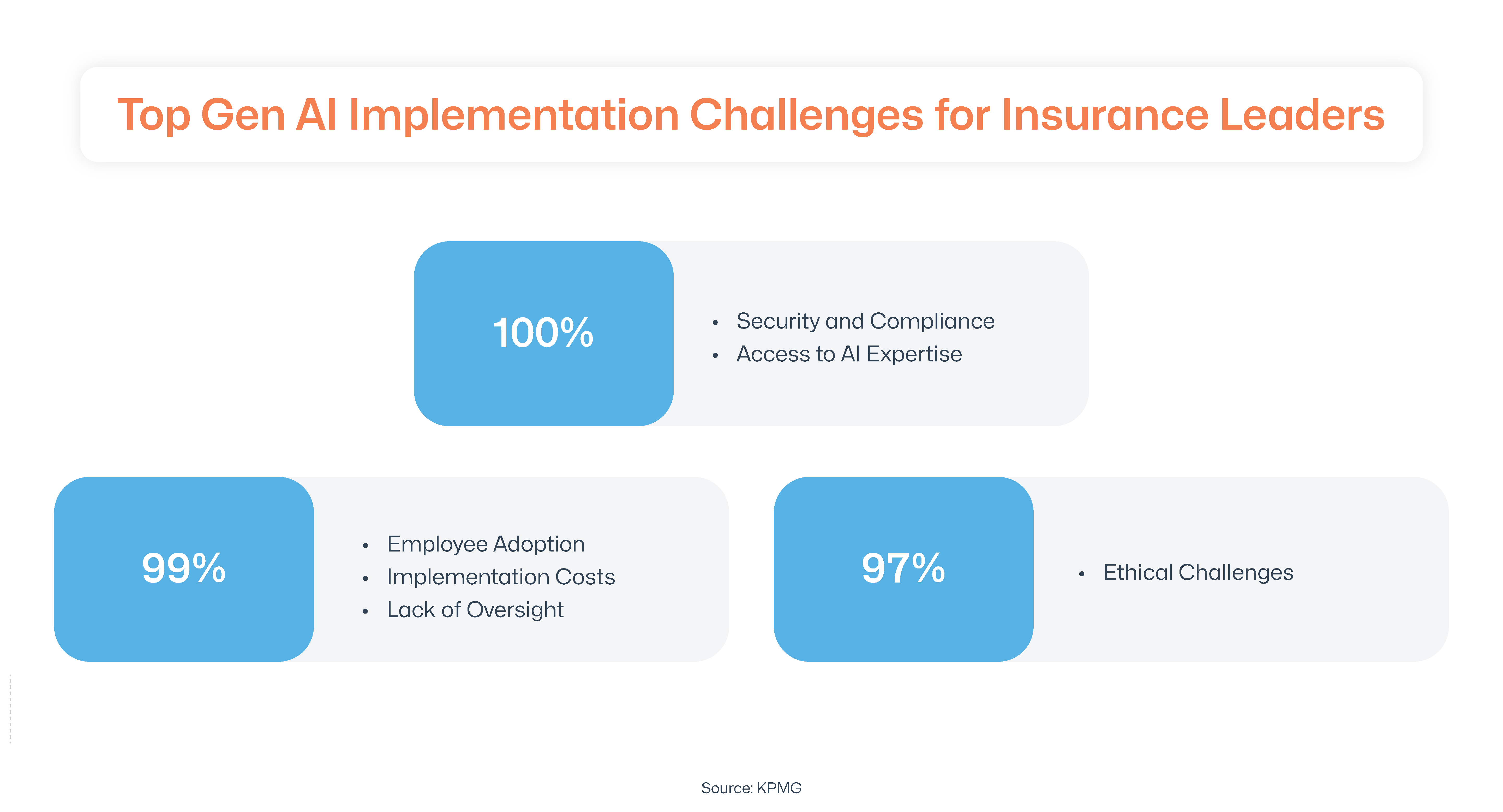

AI Adoption Challenges in the Insurance Industry

AI is catalysing innovation in insurtech. However, the adoption of the technology can be a complex web of regulatory compliance, technology integrations, and privacy protection. The most prominent challenges across the insurance industry are lack of expertise and managing backward compatibility with legacy systems. Another concern among AI adopters is preventing human bias from penetrating machine learning models, leading to discrimination against certain applicants or conditions.

Navigating the Challenges of Implementing AI in Insurance

Did you know that the insurance industry has a data drought when it comes to training AI in insurance? That is why 79% of insurers are already using or considering the use of synthetic data. However, technology enablers with expertise in AI in insurtech adoption have massive data repositories from trusted sources and ensure that all data-sharing regulations (for real data) are adhered to.

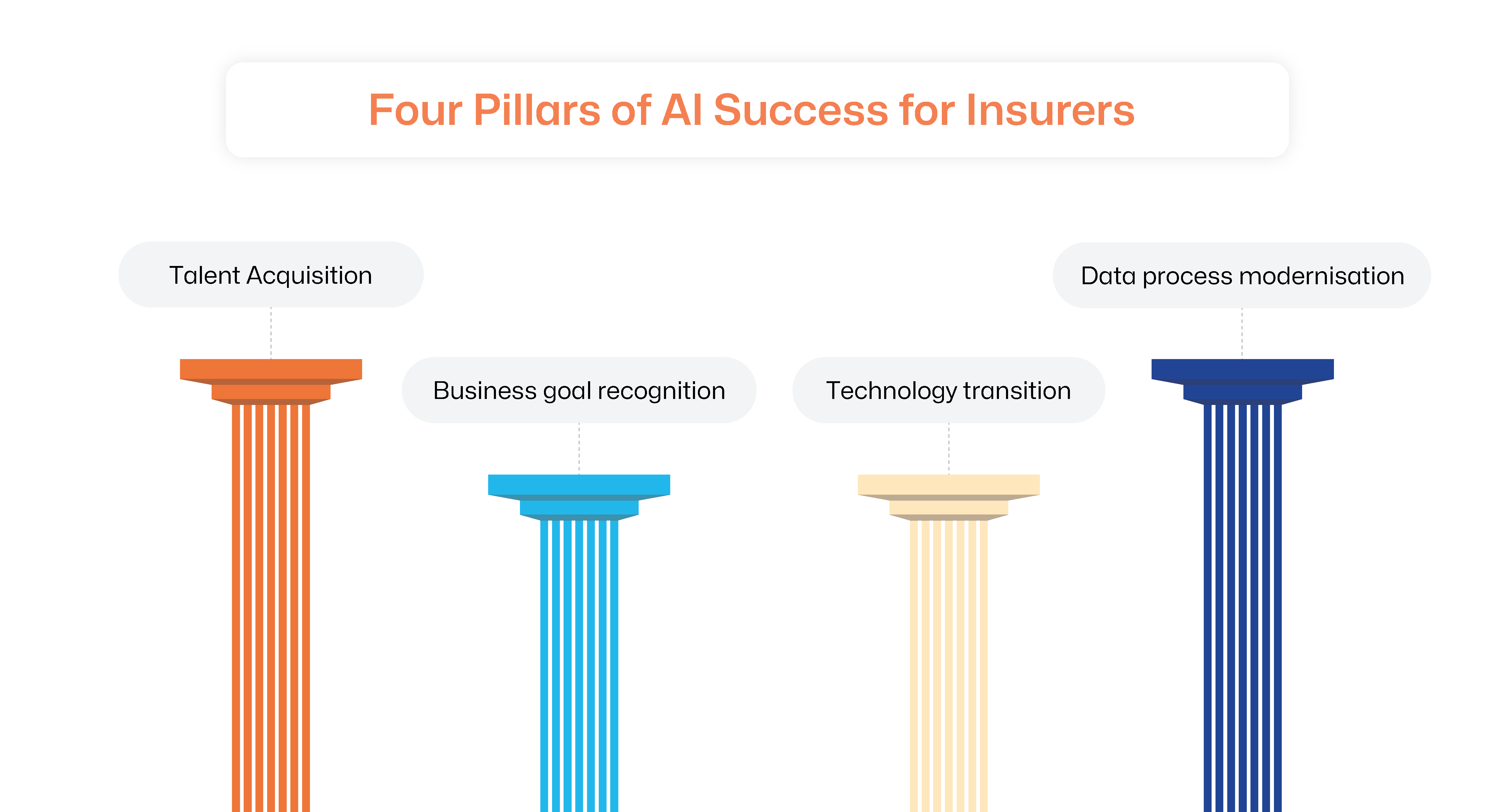

Trusting a reputed technology provider that leverages APIs for integrating AI solutions to existing software applications can accelerate adoption while minimising downtime and cost implications. These experts include AI-powered compliance management suites to keep your business on top of the latest AI and insurance regulations in India. These can effortlessly be extended to international regulations as you expand overseas. The best technology provider would take over business analysis, AI strategy development, talent acquisition, insurtech modernisation, data cleansing and ingestion, and integration of AI in insurance processes to drive business success for you.

Embracing AI in Insurance Technology is a Business Imperative

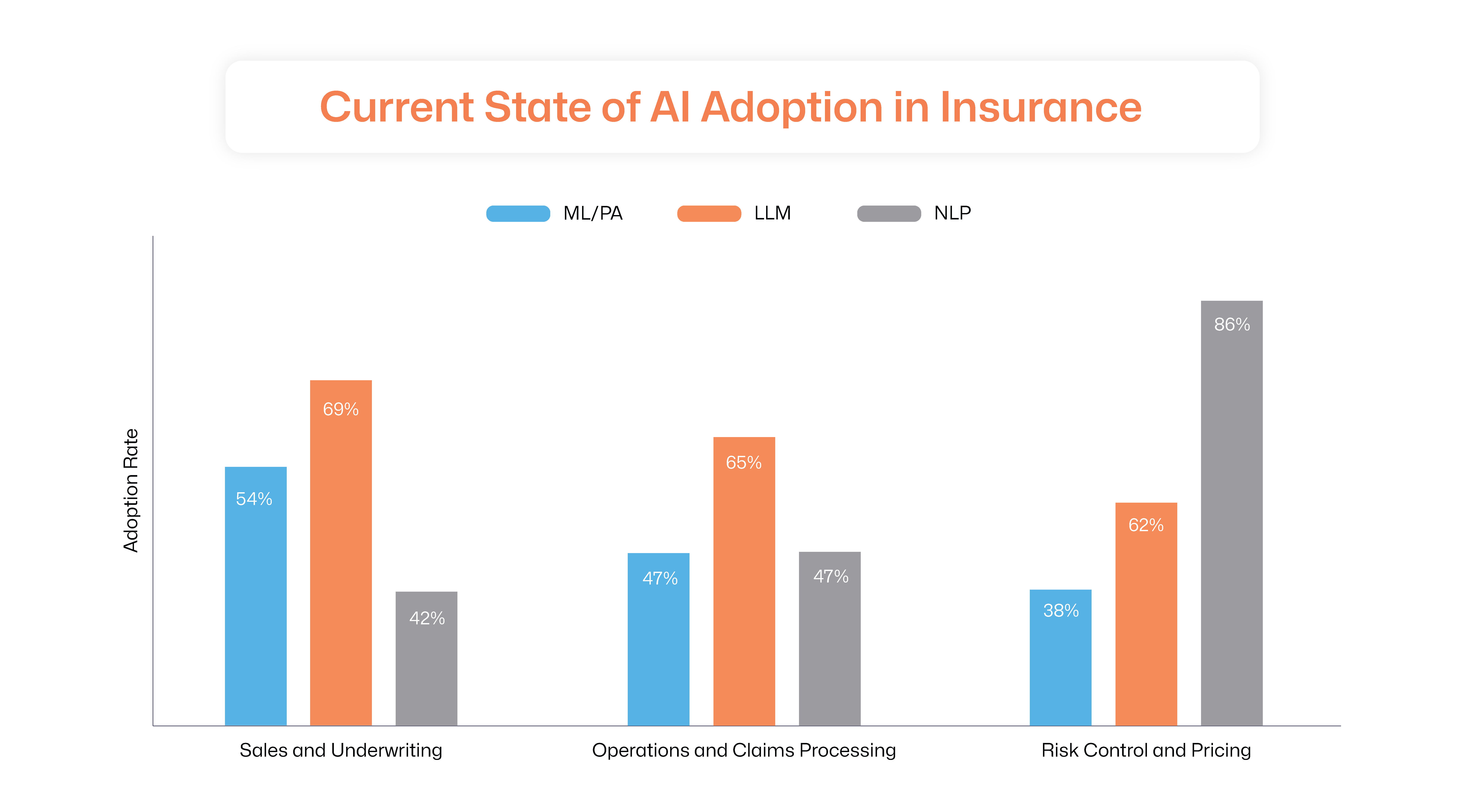

Nearly 77% of C-suite decision-makers claim to have green-lighted AI use in their business value chain, thanks to the profound impact AI has on insurance. Three primary applications of AI in the insurance value chain are sales and underwriting, claims processing and operations, and risk control and pricing. As the technology evolves, many more use cases are bound to emerge. Embracing the tech-driven shift to AI is increasingly a business imperative for the intensely competitive insurance space. Start now with AI-powered insurtech to future-proof your organisation.

Bibliography (Last accessed on Feb 26, 2025)

https://www.precedenceresearch.com/artificial-intelligence-in-insurance-market

https://riskandinsurance.com/insurance-industry-increasingly-adopting-ai-technologies-study-shows/

https://fintech.global/wp-content/uploads/2024/06/AIFinTech100-Report-2024-2.pdf

https://kpmg.com/xx/en/our-insights/ai-and-technology/ai-in-insurance-a-catalyst-for-change.html

https://www.spear-tech.com/7-types-of-ai-and-their-roles-in-transforming-the-insurance-industry/ https://www.ibm.com/think/topics/ai-in-insurance

https://fintech.global/2024/03/12/how-ai-is-transforming-insurtech/