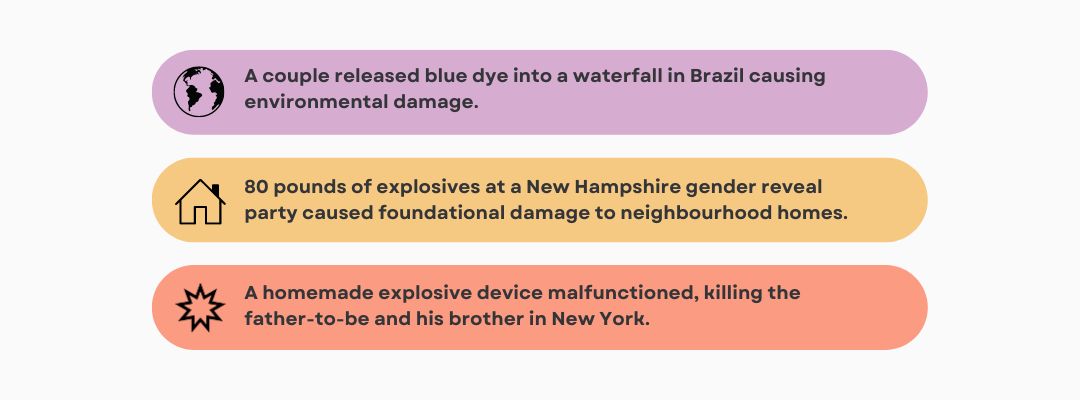

Little did Jenna Karvunidis know when she baked a cake with pink frosting in the middle, it would wreak havoc on the world. In 2008, Jenna, a Los Angeles-based influencer, held a small gender reveal party to announce the gender of her unborn child in a slightly dramatic fashion. Her video became wildly popular and gave ‘birth’ to a new social media trend - gender reveal parties. Fast forward to today, gender reveal parties have taken a dangerous turn as expectant parents have adopted outlandish ways to unveil the gender of their yet-to-be-born baby resulting in accidents, fatality, property and environmental damage.

All these events have something in common - risk. As insurers grapple with the consequences of these increasingly reckless events, it's imperative to examine the risks and implications for individuals and the insurance industry.

All these events have something in common - risk. As insurers grapple with the consequences of these increasingly reckless events, it's imperative to examine the risks and implications for individuals and the insurance industry.

The Human Cost

The consequences of gender reveal accidents can be devastating, resulting in serious injuries, lifelong disabilities, and even loss of life. A female guest got struck with a piece of flying metal at a gender reveal party when the contraption built by the family exploded sending sharp metal debris flying around. In addition to the physical toll, these accidents can also have profound emotional and psychological impacts on those involved, including the expectant parents, their families, and the broader community.

The Financial Fallout

In addition to the human cost, gender reveal accidents can also have significant financial implications for insurers and policyholders. Property damage resulting from wildfires, explosions, and other accidents can lead to costly insurance claims, resulting in financial losses for insurers and potential premium increases for policyholders. Moreover, liability claims stemming from injuries or fatalities can result in legal expenses, settlements, and judgments, further exacerbating the financial fallout of these incidents. A couple was charged $8 million in damages when the explosive they built ended up burning 45,000 acres of national forest. In another incident, a pyrotechnic device used for gender announcement burned down 22,000 acres of forest in California and killed a firefighter. The parents-to-be were sentenced to involuntary manslaughter.

Mitigating The Risks

In response to the growing risks posed by gender reveal parties, insurers should be taking proactive measures to mitigate the potential consequences. Stricter underwriting guidelines and risk assessment protocols need to be built into the framework. Additionally, insurers should partner with stakeholders, including policymakers, event planners, and community organisations, to raise awareness about the dangers of gender reveal stunts and promote safer alternatives.

Conclusion

We’ve established one fact - the consequences of gender reveal parties could be devastating. As gender reveal parties continue to capture the public's imagination, insurers are grappling with the risks and implications of these increasingly elaborate and hazardous events. By raising awareness, implementing stricter guidelines, and promoting safer alternatives, insurers can help mitigate the risks associated with gender reveal parties and protect the well-being of policyholders and communities alike.